Britain's property market is going to implode as housing nears peak affordability

Inception the movie/Warner Bros

Property prices in Britain may be surging due to a horrendous imbalance of supply and demand — but the market is poised to implode.

Why? Because Britons are not earning enough money to either get on the housing ladder or are spending such a large portion of their wages on mortgages that may not be sustainable.

Well, not unless everyone suddenly gets a huge pay rise over the next year or so.

That's the assumption in the latest figures from think tank Resolution Foundation, which show that lower- and middle-income households are spending 26% of their salaries on housing, compared to 18% back in 1995. In London, households spend 28% of their income on housing.

The think tank said this is the equivalent to adding 10 percentage points onto income tax.

Only the rich are not feeling the pressure of rising house prices. Higher-income households spend 18% of their income on housing, compared to 14% in 1995.

Inception the movie/Warner BrosThe average price to buy a house in Britain now stands at £291,504, according to the Office for National Statistics. Meanwhile, the average London property price is at a huge £551,000.

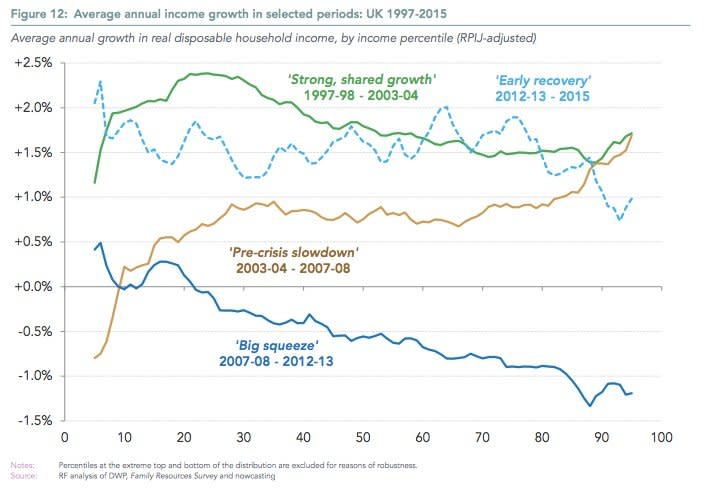

To put this into perspective, Resolution Foundation estimated that median income, at £24,300, is only around 3% higher than it was when the credit crunch hit in 2007/2008.

Take a look at this recent chart from Citi, which shows that the house price-to-earnings ratio is near the pre-crisis peak.

Considering the average deposit to secure a home is around 10% of the total property price, this means Britons are taking on huge amounts of debt and eating into the little savings they have to buy a home.

People feel comfortable taking on more debt because interest rates have been at a record low since 2009, at 0.5%. Lower interest rates make the cost of borrowing cheaper, so servicing a mortgage is currently manageable for most.

"Spiralling house prices and stagnating wage growth created a growing wedge between housing costs and incomes, which peaked on the eve of the crash," said Lindsay Judge, senior policy analyst at the Resolution Foundation.

Inception the movie/Warner Bros"Falling housing costs helped soften the living standards squeeze for many households during the downturn. But these costs are rising again and risk holding back the living standards recovery. This is particularly the case in London where any benefit from rising incomes is being wiped out by steeper housing cost increases."

Already, research from the Royal Institution of Chartered Surveyors, estate agent Savills, the Council of Mortgage Lenders, and bank analysts has said prices will continue to rise over the next five years. Even a study published by Santander showed average house prices across the country will more than double to around £500,000 over the next 15 years.

But wages are not rising as radically.

So the market is poised on a knife edge between interest rates and wages. If interest rates were to rise — and they will eventually — it could prove a major problem for the Britons who already spend 25-28% of their salaries on housing. Similarly, if another downturn depresses wages, mortgage payments will become an increasing portion of their income even without an interest rate increase.

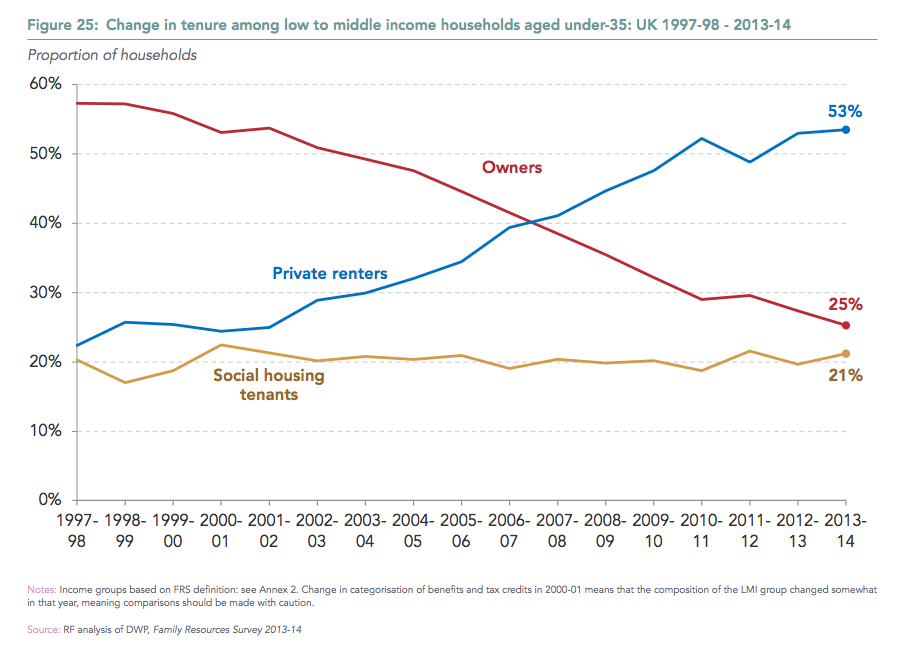

That situation is pricing out low- and middle-income people from the market, as this chart shows:

Inception the movie/Warner Bros

Ownership rates in this group have sunk from nearly 60% in 1997 to just 25% today.

That's how fragile the housing market is: With those buyers unable to afford to buy, the market is dependent on a thinner slice of owners, whose incomes are increasingly stretched by housing costs, who can't afford a decrease in wages, and who may not be able to afford any increase in interest.

NOW WATCH: How ISIS makes over $1 billion a year

See Also:

Mortgage lender Nationwide is giving loans to people who are more likely to die than pay them off

A Brexit will kill property prices in Britain— but it's also bad news for buyers

A Brexit could spell a mass exodus of EU workers because they'd fail immigration rules

SEE ALSO: Britain's property market is on the cusp of a crash as household finances reach breaking point

Yahoo Movies

Yahoo Movies