Broadridge Financial Solutions Q4 Preview: Another EPS Beat Inbound?

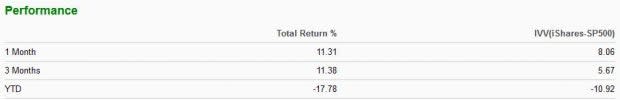

The Zacks Business Services sector has been hot over the last month, gaining an impressive 11% and widely outperforming the S&P 500. Still, the sector has underperformed year-to-date. Below is a table illustrating the sector’s performance vs. the S&P 500 over several timeframes.

Image Source: Zacks Investment Research

Broadridge Financial Solutions BR, a company in the sector, is scheduled to unveil Q4 results on August 12th, before market open.

Broadridge is a global financial technology company that offers investor communications and technology-driven solutions to banks, broker-dealers, asset managers, and corporate issuers.

The company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a D. How does the financial giant shape up heading into the print? Let’s take a closer look.

Share Performance & Valuation

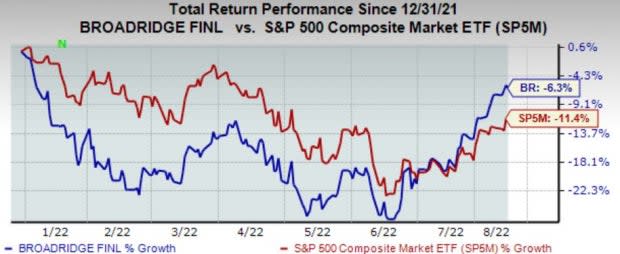

Broadridge shares have been much more defensive than the S&P 500 year-to-date, declining nearly 7%.

Image Source: Zacks Investment Research

Over the last month, BR shares have continued to outperform the general market, tacking on a substantial 16% in value.

Image Source: Zacks Investment Research

BR’s forward earnings multiple resides on the high side at 24.3X, but the value represents a solid 18% discount relative to its Zacks Sector. In addition, the value is just below its five-year median of 25.1X.

BR sports a Style Score of a C for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Zero analyst estimate revisions have hit the tape for the quarter to be reported over the last 60 days. Still, the Zacks Consensus EPS Estimate of $2.66 pencils in a rock-solid 21% uptick in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

BR’s top-line also looks to enjoy notable growth, with the $1.7 billion quarterly revenue estimate registering a 9.5% uptick from year-ago sales of $1.5 billion.

Quarterly Performance & Market Reactions

Broadridge has posted strong bottom-line results as of late, exceeding the Zacks Consensus EPS Estimate in four of its last five prints. Just in its latest quarter, BR recorded a 9% bottom-line beat.

Revenue numbers have also been stellar – the company has penciled in eight top-line beats over its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

The market has had mixed reactions following the company’s quarterly prints, with shares moving down three times and up three times following its last six earnings reports.

Putting Everything Together

BR shares have enjoyed market-beating price action year-to-date and over the last month. In addition, valuation multiples reside on the high side but are nicely below its Zacks Sector average.

Quarterly estimates reflect solid growth on the bottom and top-line, and analysts haven’t touched their earnings estimates over the last 60 days.

Furthermore, the company has consistently reported quarterly results above expectations, but the market has had mixed reactions following the prints as of late.

Heading into the release, Broadridge Financial Solutions BR carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 0.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Movies

Yahoo Movies