Budget 2017: All you need to know about the stamp duty axe and housing plans

House prices could actually climb once more after Philip Hammond axed stamp duty for homes up to £300,000, experts have warned.

While the chancellor billed the move as a boost for first-time buyers , analysts said it could backfire.

The measure will also apply on the first £300,000 of a £500,000-plus property, meaning 95% of first-time buyers will see at least a cut in the amount of stamp duty, with 80% paying none at all.

Martin Upton, director at the Open University Business School, said as first-time buyers would potentially have more spending power, that could see asking prices rise.

“This is a ‘nice’ gesture but it’s not really the silver bullet that’s going to open up the property market for those who can’t afford it,” he said.

“In the grand scheme of things, this is a small saving and it doesn’t address the biggest problem of the deposit required to make the move.”

His view was echoed by the Office for Budget Responsibility which said the main beneficiaries would be those who already own property, rather than first-time buyers, as it would mean they can sell their homes for more.

In a Budget that put Britain’s “broken housing market” front and centre of plans for the government, the chancellor left pulling the stamp duty rabbit out of the hat until right near the end of his hour-long speech.

The move comes into effect immediately, potentially saving thousands of people thousands of pounds.

“This is our plan to deliver on the pledge we have made to the next generation that the dream of home ownership will become a reality in this country once again,” Hammond said.

MORE: Budget 2017: buy-to-let investors face higher taxes on capital gains

Stamp duty – the numbers:

For the average first-time purchase of £208,000, the current £1,660 stamp duty is being axed.

A £300,000 purchase would have seen a £5,000 stamp duty charge – now, no such cost.

A £410,000 average first-time buyer property in London would have resulted in a £10,500 stamp duty for a first-time buyer – now that falls to £5,500.

For properties costing £500,000, the charge will drop from £15,000 to £10,000.

Stamp duty is unchanged on properties above £500,000.

Alison Platt, boss of Countrywide, one of the UK’s largest estate agents, said: “Stamp duty is a significant hurdle for all buyers, not just first-time buyers.

“It is activity among movers that is most critical to the growth of transactions in the wider housing market. While first time buyers face affordability issues, so do movers and without making it easier for these second steppers to move on the supply of property to buy will always be limited, adding more to price pressures.”

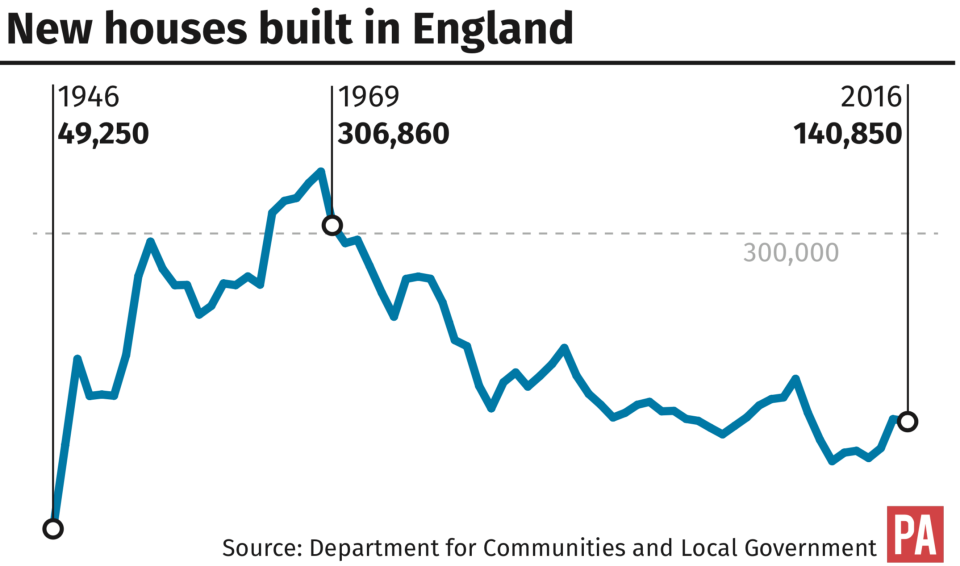

The chancellor also used his Budget statement to pledge to build 300,000 more homes every year.

He unveiled £44bn of capital investment and measures aimed at getting building projects started.

Hammond ordered a review of planning laws – seen by the industry as a major impediment to building projects – and said he would tackle the problem of “land-banking”.

The chancellor threatened compulsory purchases if necessary to get projects off the ground. Further measures included a £630m small-sites fund to “unstick” the delivery of 40,000 homes, and a further £2.7bn to more than double the Housing Infrastructure Fund.

Frank Nash, partner and head of the property group at accountants Blick Rothenberg, said much of what the chancellor was proposing relied on how Brexit was delivered.

“We will rely heavily on European workers to fill the gaps in our construction industry, so if the government are to demonstrate they can build, they must do a deal on EU nationals living and working here – quickly.

“Housing developers need people – we need beefed-up planning departments and guaranteed input for EU construction workers. Without these two things there would be more delay,” he said.

The proposals, particularly those relating to planning applications and available land, would put great pressure on the green belt and countryside.

In other measures outlined in the Budget, the chancellor outlined:

£3bn to cover various costs associated with dealing with Brexit for the next two years.

Duty on beer, cider and spirits has been frozen this time – although there will be an increase on some high-strength drinks, including some white ciders.

An additional duty on hand-rolling tobacco, on top of the previously announced inflation plus 2% rise in tobacco duty.

His speech was peppered with gags, including making reference to having cough sweets on hand after prime minister Theresa May’s croaky performance at the Tory party conference.

He also had a dig at Labour’s expense, highlighting former Scottish party leader Kezia Dugdale’s I’m A Celebrity… appearance: “There’ll be plenty of others joining Kezia Dugdale in saying ‘I’m Labour, get me out of here’.”

But Jeremy Corbyn, Labour leader, did not see the funny side. He attacked the Budget as a “record of failure”, predicting it would “unravel” within days, continuing the “misery” for people across the country.

“People were looking for help from this Budget and they have been let down by a government that, like the economy they have presided over, is weak and unstable and in need of urgent change,” he said.

Yahoo Movies

Yahoo Movies