Lionsgate Stock Jumps 11% on Analyst Upgrade Ahead of Studio Spin-Off

Shares of Lionsgate jumped over 11% on Monday after the studio received a stock upgrade ahead of the planned spin-off of its studios business from Starz via a $4.6 billion SPAC deal with Screaming Eagle Acquisition Corp.

Barrington Research analyst James Goss raised his rating on the stock to outperform from market perform with a $12 price target.

He noted that the deal, which is expected to begin in April, prospectively creates a “publicly traded subset of the studio business that would provide both some public affirmation of value and create a focus on the studio identity, while also drawing somewhat of a line in the sand in terms of transaction timing.”

“Lionsgate has made several small, but important acquisitions that should enhance the studio business and will be the primary value driver on which we plan to focus our attention,” Goss added. “For these reasons, we are upgrading our rating to Outperform.”

He expects that Lionsgate will be able to “increase focus on alternatives for Starz” following the closing of the SPAC transaction.

The SPAC deal is expected to raise approximately $350 million to fund strategic initiatives, with $175 million in financing already committed. Lionsgate is expected to own 87.3% of the new entity, known as Lionsgate Studio Corporation, which will trade on the Nasdaq under the stock symbol LION. Lionsgate Entertainment will continue to own Starz and its content relationship with the studios business will remain unchanged.

Management has previously touted the transaction as an opportunity to significantly reduce leverage, increase “strategic optionality” for Starz and its studios business, and preserve Lionsgate’s “highly attractive capital structure.”

Looking ahead, it expects Lionsgate Studios to report adjusted operating income of $300 million to $350 million for fiscal 2024, not including the impact of the eOne acquisition. For fiscal 2025, it expects the entity will generate $370 million in adjusted OIBDA before eOne. It expects eOne will exit the year with an annual run-rate adjusted operating income contribution of $60 million.

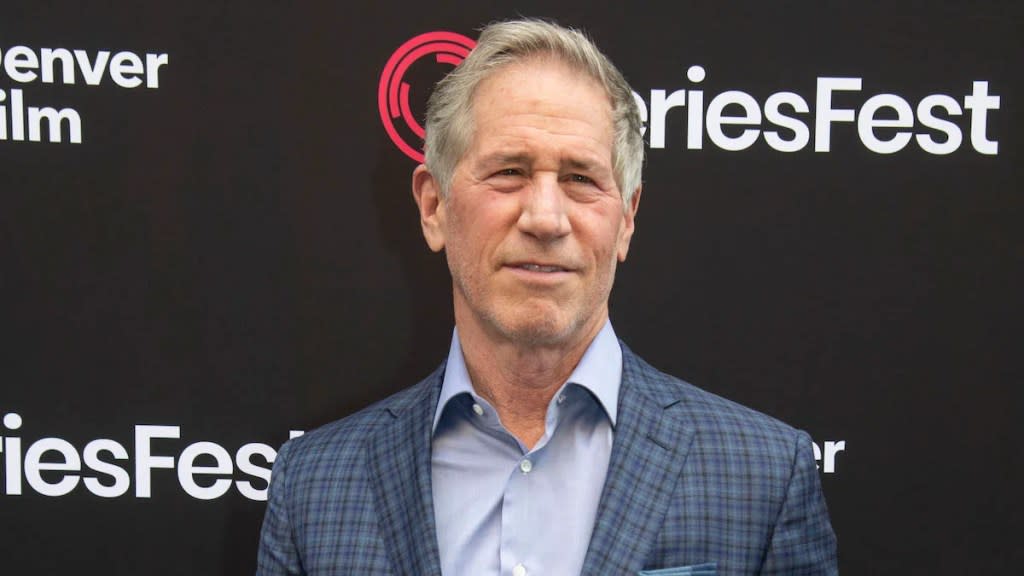

In addition to the upgrade, Lionsgate CEO Jon Feltheimer picked up 100,000 shares of the company’s stock on Thursday, according to a filing with the U.S. Securities and Exchange Commission.

The purchase included 50,000 Class A shares bought at $9.12 apiece and 50,000 Class B shares bought at $8.56 apiece.

Lionsgate shares are up 20.9% in the last six months and 11% in the past year, but down 6.6% year to date.

The post Lionsgate Stock Jumps 11% on Analyst Upgrade Ahead of Studio Spin-Off appeared first on TheWrap.

Yahoo Movies

Yahoo Movies