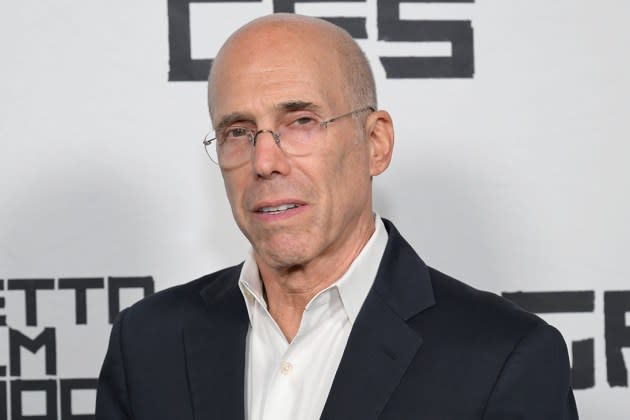

Jeffrey Katzenberg’s WndrCo Raises $460M

Jeffrey Katzenberg has raised a boatload of cash for his holding company WndrCo.

The former Disney Studios chairman and Dreamworks founder and CEO has raised $460 million for the investment firm he co-founded with Sujay Jaswa, across both seed and venture funds. WndrCo says it will use the cash to invest in “high-potential companies solving big problems across the future of work, consumer technology, cybersecurity, and developer infrastructure.”

More from The Hollywood Reporter

Jeffrey Katzenberg: AI Will Drastically Cut Number of Workers It Takes to Make Animated Movies

Jeffrey Katzenberg Confirmed to Present Award to Byron Allen at Visionary Ball in Beverly Hills

Why Jeffrey Katzenberg and Rabbi Marvin Hier Journeyed to Jerusalem With a Letter From Hitler

Katzenberg and Jaswa founded WndrCo in 2016, and the firm has managed some $1.3 billion in assets. The company;s investments include 1Password, Airtable, Aura, Databricks, Figma, and Super Unlimited.

Of course, since founding the investment firm, the entertainment veteran also founded and shut down the ill-fated short-form video platform Quibi.

More recently, Katzenberg has been speaking out about the impact that artificial intelligence will have on society and business (including on the entertainment business) and working with President Biden’s reelection campaign.

“Imagination has always been in my DNA. When Sujay and I founded WndrCo, we aspired to be the ‘founders behind the founders’ – helping entrepreneurs harness their vision and navigate the challenges it takes to build something truly groundbreaking,” said Katzenberg in a statement. “Today, with our newest funds, we’re doubling down on that mission by investing in audacious founders who are redefining how we live, work, and protect ourselves. Each WndrCo partner has built companies with global impact, and we are ready to share and act on those hard-won lessons alongside entrepreneurs.”

“We go beyond investing by actively building companies, which makes us attuned to every challenge and opportunity our entrepreneurs face,” Jaswa adds. “Jeffrey is a masterful storyteller who can open doors few can, ChenLi Wang is one of Silicon Valley’s leading product thinkers, Jeff Nykun lends his analytical prowess from public and private markets to catalyze portfolio company growth, and Anthony Saleh sits at the epicenter of culture and consumer behavior. Together, we harness our collective expertise to transform ambitious visions into reality. We have the patience and expertise to build world-changing companies, and with these latest funds, we’re excited to fuel the next wave of groundbreaking innovations.”

Best of The Hollywood Reporter

Yahoo Movies

Yahoo Movies