Financial phobia: What is it and how to beat it

We’re all a little guilty of hiding our head in the sand when it comes to our finances, kidding ourselves that the overdraft money is actually ours or leaving bank statements unopened for a few days, however, for some people the fear of money is a real and serious thing.

It’s estimated that one in five people in the UK suffer from financial phobia – a fear of dealing with personal financial issues. It manifests itself in many ways, from not being able to check your bank account to feeling nauseous and full of panic every time you think about your finances.

READ MORE: Denise Welch: 'I’d like everyone in the world to have clinical depression for 15 seconds'

Actress and Loose Woman star Denise Welch is one of those people. Speaking on White Wine Question Time, she revealed that her financial phobia, also known as chrometophobia, has meant she’s made some really bad decisions when it comes to money.

“I've made some pretty dire investments,” she told podcast host Kate Thornton. “I've not been great with all of that. I've got financial phobia, which apparently is an illness. I can't talk about money, but I can spend it!”

Jane Tully, director of external affairs at the Money Advice Trust, the charity that runs National Debtline and Business Debtline, believes talking about money is problematic for many people.

“Talking about our money can be a really difficult thing to do,” she says. “Embarrassment, shame and stress are common reasons we hear for people not talking about money worries. These are often the main barriers to seeking help earlier, during which time debts can increase.

“But it doesn’t have to be this way. The earlier you seek advice on dealing with money issues, the quicker and easier they are to resolve.”

What causes financial phobia?

Lynette Evans, an integrative counsellor and psychotherapist, says that just like other phobias, financial phobia can be a response to things that have happened to that person in their life.

“Phobias can be a learned response developed in early life from our parents, caregivers or siblings in our family environment,” she says.

“For example, if you have a father who is constantly worrying and anxious about finances this can affect the way in which we cope with our worries and anxieties as we get older. This may lead us to develop the same phobia.”

READ MORE: Can stress actually kill you?

Stress is also a contributing factor, especially when dealing with something as integral to life as money.

“Stress, long term, can decrease our capability to manage specific situations,” says Lynette. “This increases our anxiety and fear about being exposed to those particular situations again and over a duration can lead to developing a phobia.”

Research at Cambridge University found that - as in Denise’s case - more women than men are affected by this particular phobia. This could be because phobias are genetically determined.

Lynette explains: “Research suggests that genetically some of us are more vulnerable than other people in developing phobias due to being born with a likelihood of being more anxious.”

As Denise explains in the podcast, her fear of finances has resulted in her making bad judgement calls and while people may joke about being afraid of their bank statements, real financial phobia can be debilitating.

“Phobias are more inescapable than fears as they grow from a magnified and illogical sense of danger in relation to the situation, feeling or object,” says Lynette. “This anxiety can cause our daily lives extreme distress as we may find ourselves organising our life trying to avoid the phobia at any cost.”

How to beat financial phobia

If you’ve noticed that you get panic attacks when dealing with money or just know that your phobia is out of hand, the best thing to do is to visit your GP. They can discuss the best options available to you.

Therapy

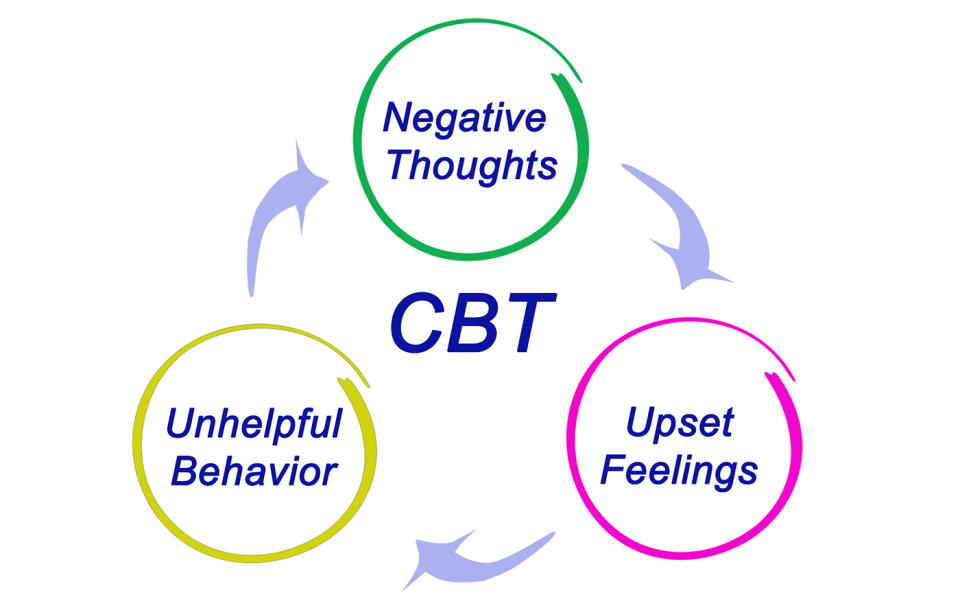

There are various therapies you can try to help you overcome your therapy including CBT (Cognitive Behavioural Therapy), counselling and psychotherapy. Some people find that exposure therapy works really well for them, where a therapist will gradually introduce them to their phobia, enabling them to gain power over what they fear the most.

READ MORE: Two in five young Brits rely on 'side hustle' to make ends meet

Another option for some is hypnotherapy – this can work on those that haven’t responded to regular counselling.

“I incorporate hypnotherapy in my practice when clients are stuck in their fear and negative thinking patterns,” explains Lynette. “I have seen positive results ranging from people walking through a flock of pigeons to driving successfully on the motorway without fear of crashing!”

Medication

While taking drugs can’t get rid of your phobia, it can help the quell the surrounding anxiety. Anti-depressants, tranquillisers and beta-blockers can all help manage symptoms

Practical help

Unlike, say, a fear of clowns, financial phobia can have a huge life-changing impact on people, especially as it can result in getting into serious debt.

Jane says that taking first steps to contact a service like National Debtline are often the hardest but can make the biggest difference in restoring your financial health.

“I would encourage anyone worried about money to seek debt advice from a service like National Debtline,” she says. “Our advisers are there to provide, free non-judgemental advice and to help you through the process of dealing with your debt.”

READ MORE: How debt impacts mental health and what to do about it

If you find the thought of talking to someone absolutely vomit-inducing, try an online tool like the National Debtline’s advice tool or webchat with an adviser.

Even though taking a first step like this can seem huge when you have a phobia, 83% of people who called the helpline said they felt more in control of their financial situation.

“As well as helping with your financial situation, seeking advice can ease the worry caused by debt,” explains Jane. “More than seven in ten callers to National Debtline say they feel less stressed six weeks on from speaking to one of our advisers.”

If you feel you need more help, book an appointment with your GP or visit the National Debtline or Mind.

Hear Denise Welch talking more about her life and how she met husband Lincoln Townley on the latest episode of White Wine Question Time. Listen now on iTunes and Spotify.

Yahoo Movies

Yahoo Movies