Lloyds Bank poaches new chief executive from HSBC

Lloyds Bank (LLOY.L) has named HSBC’s Charlie Nunn as its new chief executive.

Lloyds on Monday said it had lined up Nunn to take over from outgoing head António Horta-Osório. It follows a four month recruitment process.

Nunn is currently head of wealth and personal banking at HSBC (HSBA.L). He joined the bank in 2011 and prior to that spent most of his career as a consultant with Accenture and McKinsey.

“I am excited about Charlie’s vision for Lloyds Banking Group, as well as his passion for and commitment to our purpose of helping Britain prosper,” incoming chairman Robin Budenberg said in a statement.

“Given his career track record, he will bring world class operational, technology and strategic expertise to build on the strengths of the existing management team.”

Nunn said: “I feel particularly lucky to be joining Lloyds Banking Group at this important time. Lloyds’ history, exceptional people and leading position in the UK means it is uniquely placed to define the future of exceptional customer service in UK financial services.

“I look forward to building on the work of António and the team and their commitment to helping Britain prosper.”

Nunn will get “fixed” pay of £2.4m ($3.2m) a year, including a base salary of £1.1m, and be eligible for share-based bonuses worth £3.2m a year.

Lloyds announced in July that Horta-Osório would step down after a decade in charge of the bank.

The exact handover date is subject to negotiations with HSBC. Nunn has a six month notice period and six month cool-off period.

Horta-Osório has said he will retire by June 2021. Lloyds said chief finance officer William Chalmers would take charge of the bank if Nunn was not in place by then.

READ MORE: Wetherspoon boss urges MPs to vote down 'economically ruinous' tier system

“Charlie will find a warm welcome at Lloyds Banking Group and a deep commitment from all of our people to deliver on our purpose and to help Britain recover,” Horta-Osório said.

“I am sure that he will find his time here as fulfilling and fascinating as I have done and I wish him the very best.”

Fahed Kunwar, head of European bank research at Redburn, said Nunn’s appointment was a surprise but made sense from a business perspective.

“What was not a surprise was that Lloyds is hiring a CEO with experience in non-interest income revenue streams, as the low interest rate environment means banks are going to have to hunt down revenues in areas other than vanilla lending and deposit taking businesses,” Kunwar said.

In a separate statement, HSBC said Nuno Matos would take over as chief executive of wealth and personal banking. Matos is currently chief executive of the non-ring-fenced HSBC Bank in the UK and head of HSBC Europe.

“I wish Charlie the best of luck in his new role and he leaves HSBC with my good wishes,” HSBC chief executive Noel Quinn said.

“I have appreciated his leadership and his support. He has made a significant impact at HSBC during his time here.”

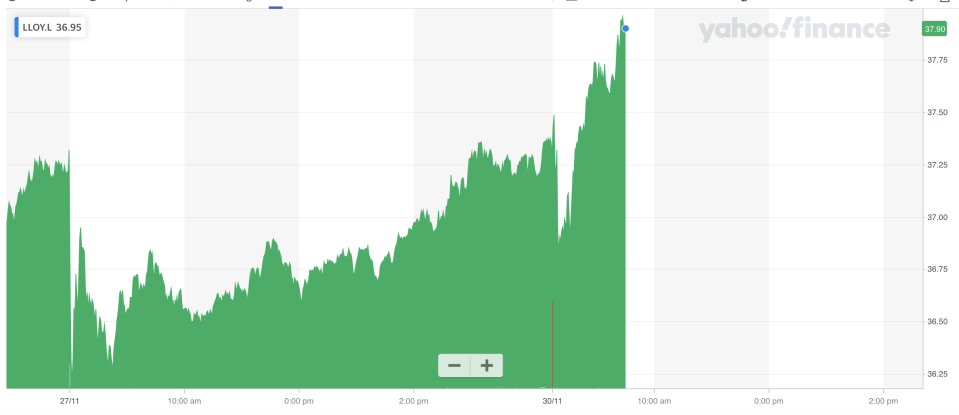

Lloyds shares rose 1.7% in morning trade in London, while HSBC’s stock dropped 1%.

Watch: Why can’t governments just print more money?

Yahoo Movies

Yahoo Movies