Air Products Awarded Onsite Contract by PCB Manufacturer

Air Products and Chemicals, Inc. APD announced that a world-leading printed circuit board (PCB) and contract manufacturer in China has awarded it another long-term onsite supply contract.

Notably, Air Products’ latest win is expected to further strengthen its strong supply position and onsite ability to serve the customer and the rapidly rising electronics markets.

Air Products plans to add one large-volume High Purity Nitrogen (HPN) generator to assist growth of the PCB and contract manufacturer in Northern China.

The company intends to substantially enhance its gas capacity for consumers by combining the new facility with the several existing HPN generators brought on-stream throughout the country over the last three years.

Additionally, Air Products has provided its proprietary NitroFAS Intelligent Nitrogen Control System (INCS) units and associated application solutions built by its Asia Technology Center in Shanghai.

Notably, the innovative offerings further improved the customer's product quality, productivity and environmental sustainability with lower emissions. Further, the INCS’ remote monitoring and control function has allowed the realization of the benefits of Industrial Internet of Things.

Air Products’ shares have gained 11% in the past year against the industry’s 27.5% decline.

Last month, the company reported second-quarter fiscal 2020 earnings from continuing operations of $2.21 per share, up 16% from $1.90 recorded in the year-ago quarter. However, adjusted earnings per share of $2.04 missed the Zacks Consensus Estimate of $2.05.

Revenues improved 1.3% year over year to $2,216.3 million for the fiscal second quarter. Moreover, the top line beat the Zacks Consensus Estimate of $2,142.6 million.

Air Products withdrew its earnings guidance for 2020 due to the unknown duration and impacts of the coronavirus pandemic. The company also has not provided earnings guidance for the fiscal third quarter due to uncertainties.

Air Products expects declines in the Americas and EMEA merchant volumes to sustain. Further, in the fiscal third quarter, it expects it to be more pronounced and potentially longer, depending on the duration and impacts of the coronavirus pandemic.

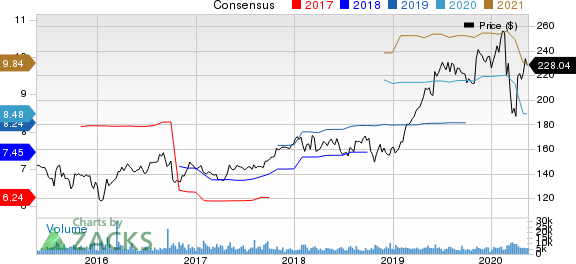

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic materials space are Gold Fields Limited GFI, Agnico Eagle Mines Limited AEM and Barrick Gold Corporation GOLD.

Gold Fields currently sports a Zacks Rank #1 (Strong Buy) and has a projected earnings growth rate of 31% for 2020. The company’s shares have surged 135.9% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agnico Eagle has a projected earnings growth rate of 75.3% for the current year. The company’s shares have rallied around 67% in a year. It presently has a Zacks Rank #2 (Buy).

Barrick has a projected earnings growth rate of 64.7% for 2020. It currently carries a Zacks Rank #2. The company’s shares have rallied 129.8% in a year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Movies

Yahoo Movies