Did You Miss Fortinet's (NASDAQ:FTNT) Whopping 813% Share Price Gain?

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. To wit, the Fortinet, Inc. (NASDAQ:FTNT) share price has soared 813% over five years. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 42% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

It really delights us to see such great share price performance for investors.

View our latest analysis for Fortinet

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

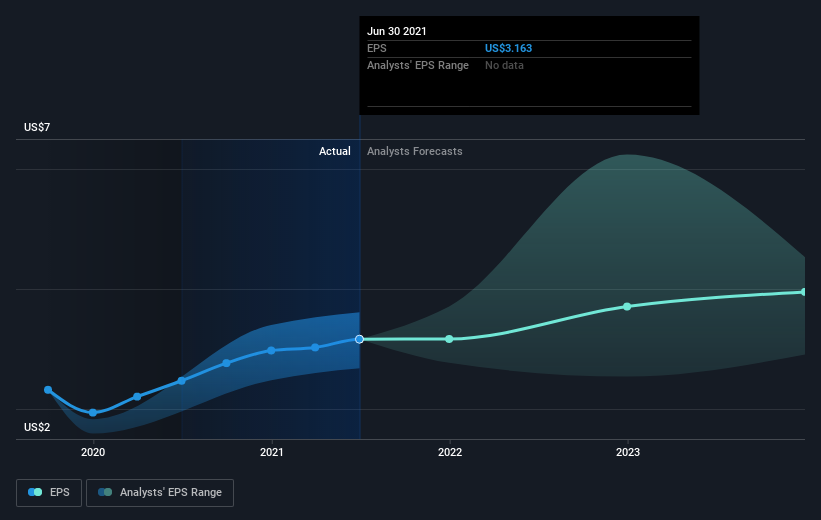

During five years of share price growth, Fortinet achieved compound earnings per share (EPS) growth of 143% per year. This EPS growth is higher than the 56% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company. Having said that, the market is still optimistic, given the P/E ratio of 94.85.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Fortinet has grown profits over the years, but the future is more important for shareholders. This free interactive report on Fortinet's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Fortinet has rewarded shareholders with a total shareholder return of 115% in the last twelve months. That's better than the annualised return of 56% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Fortinet you should know about.

Of course Fortinet may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies