If You Had Bought Affimed (NASDAQ:AFMD) Shares A Year Ago You'd Have Made 62%

It might be of some concern to shareholders to see the Affimed N.V. (NASDAQ:AFMD) share price down 20% in the last month. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. Looking at the full year, the company has easily bested an index fund by gaining 62%.

View our latest analysis for Affimed

Affimed isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Affimed grew its revenue by 977% last year. That's stonking growth even when compared to other loss-making stocks. While the share price gain of 62% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Affimed. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

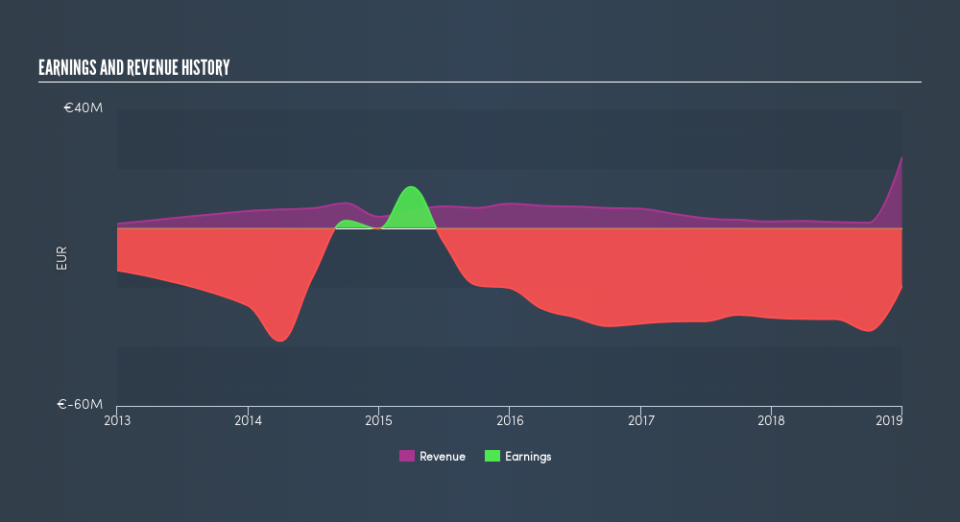

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Affimed shareholders have gained 62% (in total) over the last year. This recent result is much better than the 6.4% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies