Here's Why Investors Should Retain Ingersoll Rand (IR) Stock

Ingersoll Rand Inc. IR is gaining from its solid product portfolio, innovation capabilities and focus on boosting its aftermarket businesses despite cost inflation, supply-chain constraints and forex woes.

Key Factors Driving IR

Business Strength: Solid demand and higher orders should drive the company’s Industrial Technologies & Services segment. The company continues to see higher orders across its product portfolio of compressors, vacuum and blowers, and power tools and lifting within the Industrial Technologies & Services unit.

For 2023, the company expects segmental revenues to increase 9-11% organically. Pricing actions and acquired assets are driving the Precision & Science Technologies segment’s performance. Acquisitions had a positive impact of 2.5% on the unit’s revenues in the second quarter of 2023. The company anticipates Precision & Science Technologies revenues to climb 5-7% organically in 2023.

Expansion Efforts: Ingersoll Rand has been strengthening its business through acquisitions. In August 2023, the company completed the acquisition of Howden Roots for approximately $300 million. The acquisition expanded IR’s low-pressure compression and vacuum product offerings and added centrifugal compression capabilities. Roots is a part of IR’s Industrial Technologies & Services segment.

In January 2023, the company completed the acquisition of SPX FLOW’s Air Treatment business, which boosted its core compressor product offering through a complementary product portfolio of energy-efficient compressed air dryers, filters and other consumables. The Air Treatment business is a part of IR’s Industrial Technologies and Services segment.

Rewards to Shareholders: The company continues to increase shareholders’ value through dividend payments. In the first six months of 2023, the company paid out dividends of $16.2 million and repurchased shares worth $132.8 million. In 2022, IR returned $294 million to shareholders through dividends and share buybacks.

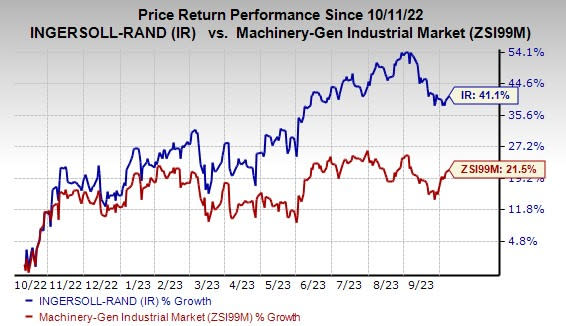

In light of the above-mentioned positives, we believe, investors should retain IR stock for now, as suggested by its current Zacks Rank #3 (Hold). Shares of IR rose 41.1% in a year, outperforming the industry‘s 21.5% increase.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Axon Enterprise, Inc. AXON currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The company delivered a trailing four-quarter earnings surprise of approximately 60.2%, on average. In the past 60 days, estimates for Axon’s earnings have increased 13.8% for 2023. The stock has soared 72% in the past year.

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank of 1 and a trailing four-quarter earnings surprise of 15%, on average.

AIT’s earnings estimates have increased 1.6% for fiscal 2024 (ending June 2024) in the past 60 days. Shares of Applied Industrial have risen 44.9% in the past year.

Caterpillar Inc. CAT presently carries a Zacks Rank #2 (Buy). CAT’s earnings surprise in the last four quarters was 18.5%, on average.

In the past 60 days, estimates for Caterpillar’s earnings have increased 2.2% for 2023. The stock has gained 50.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report

Yahoo Movies

Yahoo Movies