Can You Imagine How IMAX's (NYSE:IMAX) Shareholders Feel About The 78% Share Price Increase?

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. For example, the IMAX Corporation (NYSE:IMAX) share price is up 78% in the last year, clearly besting the market return of around 44% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! The longer term returns have not been as good, with the stock price only 4.1% higher than it was three years ago.

See our latest analysis for IMAX

IMAX isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

IMAX actually shrunk its revenue over the last year, with a reduction of 60%. Despite the lack of revenue growth, the stock has returned a solid 78% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

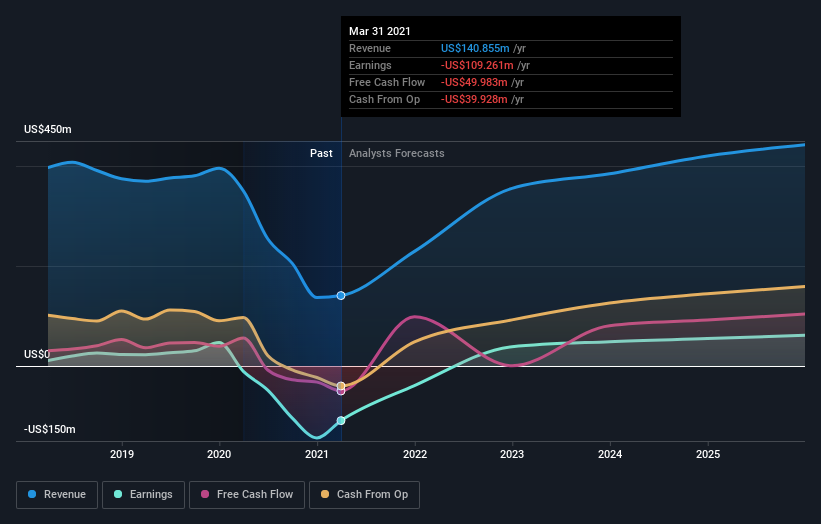

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

IMAX is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for IMAX in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that IMAX shareholders have received a total shareholder return of 78% over the last year. That certainly beats the loss of about 4% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with IMAX (including 1 which is a bit concerning) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies