Would Shareholders Who Purchased CytomX Therapeutics' (NASDAQ:CTMX) Stock Three Years Be Happy With The Share price Today?

While not a mind-blowing move, it is good to see that the CytomX Therapeutics, Inc. (NASDAQ:CTMX) share price has gained 17% in the last three months. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 65%. Some might say the recent bounce is to be expected after such a bad drop. The rise has some hopeful, but turnarounds are often precarious.

Check out our latest analysis for CytomX Therapeutics

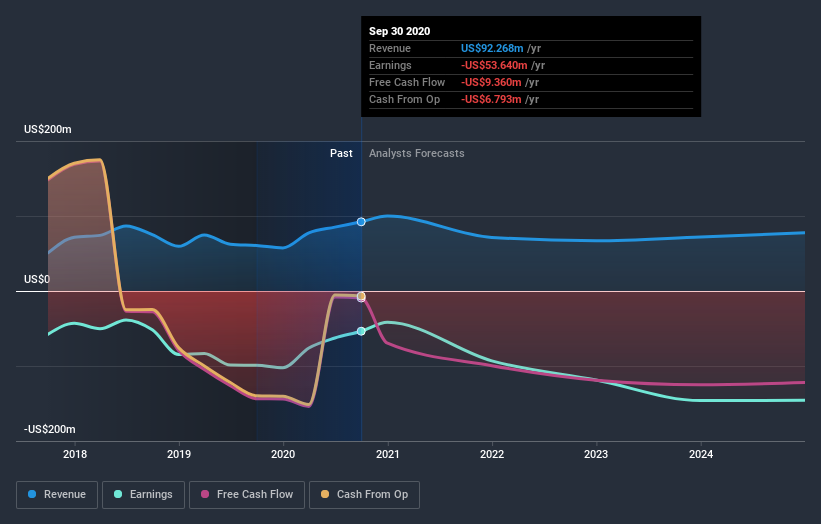

Because CytomX Therapeutics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, CytomX Therapeutics grew revenue at 6.7% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 18% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). After all, growing a business isn't easy, and the process will not always be smooth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in CytomX Therapeutics had a tough year, with a total loss of 12%, against a market gain of about 23%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand CytomX Therapeutics better, we need to consider many other factors. For instance, we've identified 2 warning signs for CytomX Therapeutics (1 makes us a bit uncomfortable) that you should be aware of.

We will like CytomX Therapeutics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Movies

Yahoo Movies