Viatris (VTRS) to Report Q2 Earnings: What's in the Cards?

Viatris VTRS, a global healthcare company, is scheduled to report second-quarter 2021 results on Aug 9.

The company was formed in November 2020 through the combination of Mylan and Upjohn. The company’s performance has been excellent, beating earnings estimates in the trailing four quarters by 16.03%, on average. In the last reported quarter, the company beat expectations by 16.46%.

Viatris Inc. Price, Consensus and EPS Surprise

Viatris Inc. price-consensus-eps-surprise-chart | Viatris Inc. Quote

Factors to Consider

Viatris reports segment information based on markets and geography. Following the formation of Viatris, the company has changed its reportable segments, from North America, Europe and the Rest of the World, to Developed Markets, Emerging Markets, JANZ (Japan, Australa and New Zealand) and Greater China.

Net Sales from Developed markets increased 29% in the previous quarter to $2.6 billion, driven by the addition of the Upjohn business. This trend has most likely continued in the to-be-quarter.

Sales from Emerging Markets too have likely seen an increase in the to-be-reported quarter, driven by net sales from the Upjohn business and new product sales.

Sales in the JANZ segment came in at $481.9 million in the previous quarter. The second quarter is likely to have seen a similar performance.

Sales from Greater China markets have also likely witnessed growth owing to the Upjohn business. Sales in the previous quarter came in at $591.9 million and the quarter under review has most likely witnessed sequential growth.

Brands performed better than expectations in the previous quarter, driven by products such as EpiPen, Amitiza, Lipitor and Viagra, and a similar or better performance has likely been witnessed by the company in the to-be-reported quarter. The generic and biosimilar business also performed well in the previous quarter driven by growth in biosimilars and the same has most likely occurred in the quarter under review.

During the fourth quarter of 2020, Viatris announced a widespread global restructuring program in order to achieve synergies. The restructuring initiative incorporates and expands on the restructuring program announced by Mylan N.V. earlier in 2020, as part of its business transformation efforts. The company expects to optimize its commercial capabilities and enabling functions, and close, downsize or divest up to 13 manufacturing facilities globally that are deemed to be no longer viable either due to surplus capacity, challenging market dynamics or a shift in product portfolio toward more complex products.

As a result, Viatris expects that up to 20% of its global workforce to be affected, upon the completion of the restructuring initiative. Further updates on the same are expected on the call.

Key Recent Development

Viatris and Biocon Biologics Ltd. announced that the FDA has approved Semglee (insulin glargine-yfgn) injection as the first interchangeable biosimilar product under the 351(k) regulatory pathway.

Share Price Performance

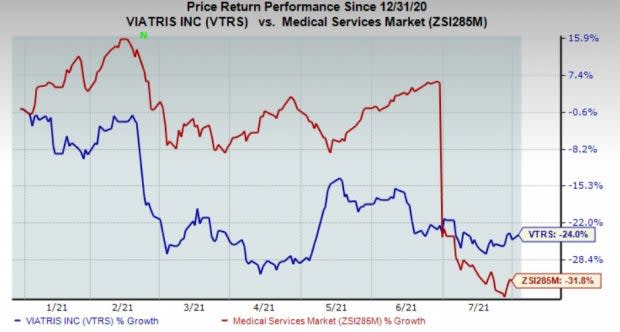

Viatris’ stock has lost 24% in the year so far compared with the industry’s decline of 31.8%.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Viatris this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP for Viatris is 0.00%.

Zacks Rank: The company currently carries a Zacks Rank #3.

Stocks to Consider

Here are a few stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season.

Ironwood Pharmaceuticals IRWD has an Earnings ESP of +11.11% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zoetis ZTS has an Earnings ESP of +4.32% and a Zacks Rank #3.

Regeneron REGN has an Earnings ESP of +12.64% and a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Ironwood Pharmaceuticals, Inc. (IRWD) : Free Stock Analysis Report

Zoetis Inc. (ZTS) : Free Stock Analysis Report

Viatris Inc. (VTRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Movies

Yahoo Movies