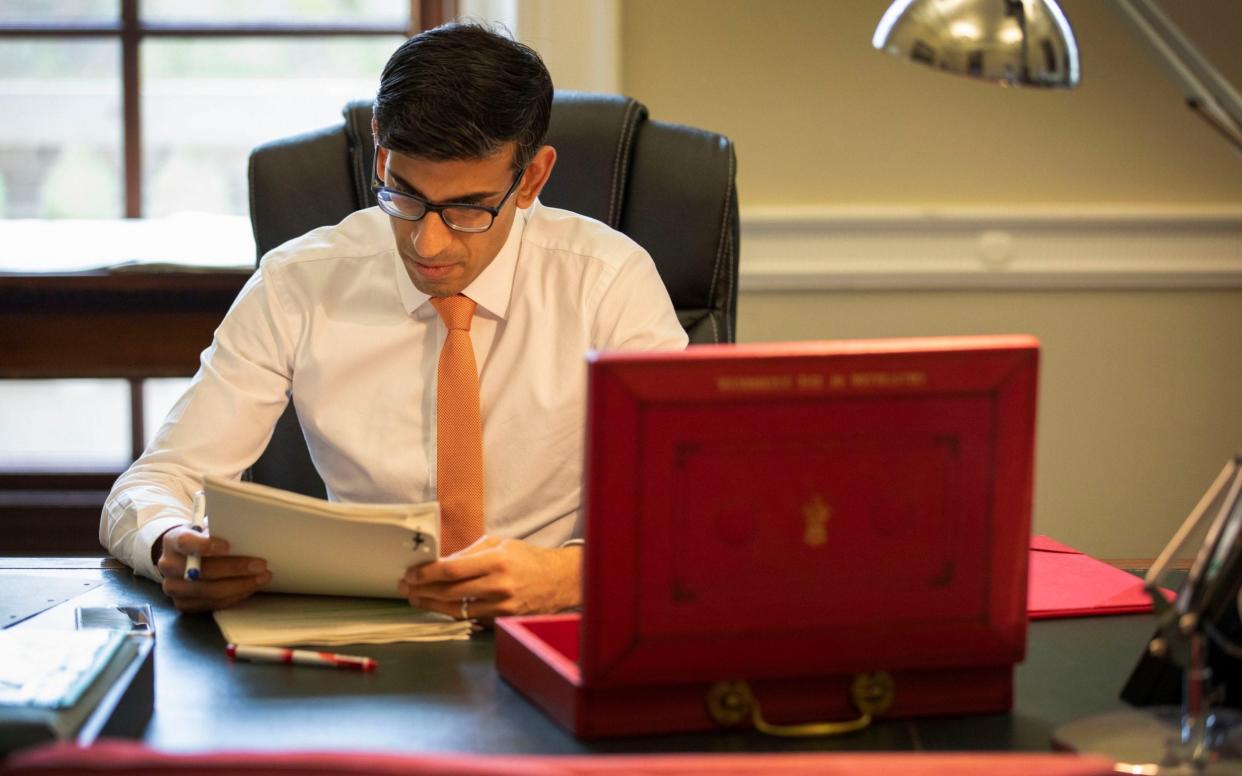

Rishi Sunak's tax changes: how much more will I have to pay and what can I do to minimise the pain?

Treasury officials are understood to be eyeing five tax rises to boost their Covid-hit coffers. Many readers will find themselves paying more if their proposals take effect. But how much more – and what could they do to limit the damage?

I’m earning £75,000 but currently pay no higher-rate tax because I put £25,000 a year in my pension, meaning it is covered by tax relief. How much more will I pay if higher-rate relief is scrapped?

Relief at the current rate of 40 per cent amounts to £10,000 a year. Twenty per cent relief is only £5,000 a year, so you would pay an extra £5,000 a year.

Is there anything I can do about it?

There are other savings options that could save you tax, although they are likely to involve more risk than your pension plan.

Venture capital trusts are funds listed on the stock market that offer generous tax breaks. There is no income tax on dividends and no capital gains tax on sale, even if you hold shares in the trusts outside an Isa or pension. You can also claim back 30 per cent of the amount you invest as an income tax rebate, but only if you buy your shares when they are issued by the trust and hold them for five years.

The Enterprise Investment Scheme is another tax-advantaged way to invest in new businesses. Again, income tax relief of up to 30 per cent is available.

I have £50,000 in shares held outside an Isa. How much more will I pay to sell them if the capital gains tax (CGT) rate rises to 40 per cent for higher-rate taxpayers?

Let’s say you paid £25,000 for the shares, so your gain is also £25,000. If the annual CGT allowance – currently £12,300 – survives, your taxable gain will be £12,700. Taxed at the current 20 per cent you would pay £2,540. Under a rate aligned with income tax of 40 per cent, your bill would be £5,080, an extra £2,540, said Mike Warburton, the Telegraph tax columnist.

Is there anything I can do to reduce the CGT bill when I sell shares held outside an Isa or pension?

Yes. One way is to spread the sale across two tax years, so that you in effect double your tax-free allowance. You can also transfer assets tax-free to your spouse or civil partner and they can then use their tax-free allowance.

I need to sell my buy-to-let property. How much more tax will I pay?

If the property cost £250,000 and is being sold for £400,000, your gain is £150,000. Taxed at income tax rates, and assuming that the annual exemption still applied, £75,000 of the gain would be taxed at 40 per cent and £62,700 would be taxed at 45 per cent, for a total of £58,125. This is £19,569 more than under the current regime.

What can I do to pay as little inheritance tax (IHT) as possible if the tax is ‘simplified’?

We don’t know the details of possible changes, but there is plenty of scope for simplification as IHT is one of the most complex taxes in existence.

The “seven-year” rule under which gifts are IHT-free if you survive for that period could go, according to Nimesh Shah of the accountancy firm Blick Rothenberg. He said one solution would be to make the gift now so it takes place under current rules.

Another target could be “business relief”, which allows some business assets, including shares in unlisted businesses, to be inherited tax-free. Some stock market investors could be hit because shares quoted on London’s junior Aim market are technically unlisted, so some qualify for business relief. You could lock in the exemption now by transferring the assets to a trust.

One way to minimise the IHT bill on your estate is to use all the existing allowances, assuming that they do not fall victim to any simplification.

For instance, families can give money to children to help pay for important life events. Parents with children who are getting married could give up to £5,000 to each child as a wedding gift; that sum then falls outside their estate.

Regular gifts from "excess" income – which means that the gifts do not affect the giver's standard of living – are also IHT free. There is no limit on the gifts if the standard of living rule is met.

There is also an annual gift allowance of £3,000. Larger gifts are tax free if the giver lives for another seven years.

Yahoo Movies

Yahoo Movies