Week Ahead: Brexit negotiations, US central bank meetings, key company results

It’s due to be a busy week in markets, as quarterly earnings season continues and key decisions are made about policy surrounding the coronavirus.

Financial releases from a range of businesses will give investors an indication about how seriously COVID-19 has hit companies’ books, with 10% of companies in the S&P 500 reporting this week. Big tech, pharma, banks and airlines will be in the spotlight.

Ones to watch include: Ryanair (RYAAY), LVMH (MC.PA), McDonald’s (MCD), Visa (V), Barclays (BCS), Facebook (FB), Wizz Air (WIZZ.L), Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), AstraZeneca (AZN).

A raft of data is also due, showing unemployment numbers across Europe and the US, as well as economic sentiment and GDP. As ever, Brexit negotiations continue.

In the US eyes will be on Jerome Powell and the federal reserve.

Markets will also be looking at weekend developments:

Britain: Brexit talks resume, travel confusion

Brexit negotiations rumble on this week, with a focus on “level playing field” regulations and fisheries.

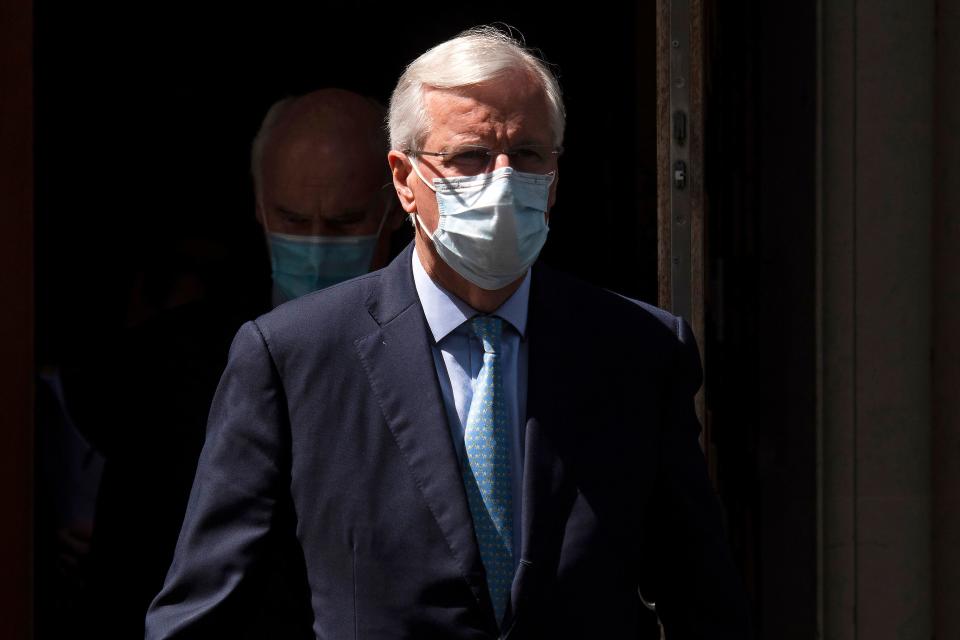

Talks had broken down last week, with the EU’s chief negotiator Michel Barnier saying that a trade deal is “unlikely” by the end of the year and no progress had been made on key issues.

Following this week’s talks, both sides will take a short break in order to prepare for the next formal round of negotiations beginning the week of 17 August.

“We only have a few weeks left,” Barnier said. “And we should not waste them.”

Travel will also be in the spotlight this week, as some carriers report quarterly and half-year results.

Airlines are sure to have something to say about the weekly revisions of air bridges by the UK government. The revelation on Saturday evening that Spain would be taken off the safe list, and people travelling back to the UK from Spain would be subject to a 14-day quarantine, caught many off guard.

Europe: Key data and recovery packages

Indications of whether Europe will see the economic rebound it had hoped for will come on Monday 27. The region’s largest economy, Germany, is due to release IFO business climate figures for July, alongside expectations and current assessments.

An EU pandemic recovery package is also in train.

Here’s what else to look out for this week:

Spain’s employment figures for Q2 are released on Tuesday.

The UK’s BRP shop price index will publish year-on-year data, also on Tuesday.

Eurozone unemployment figures for June come out on Thursday, as does the ECB’s economic bulletin.

Friday brings Euro-area, France, Italy and Spain’s GDP data, inflation.

US: All eyes on the Fed

As US coronavirus cases continue to rise, and jobs data last week was worse than expected, concerns are growing across the Atlantic that progress with economic recovery may be stalling.

The Federal Reserve’s two-day FOMC meeting will be a focal point this week. Jerome Powell and the monetary policy committee are not expected to change the US benchmark interest rate, however we could see some longer-term stimulus plans as countries use all the tools at their disposal to support recovery.

The timetable for releases is as follows:

28 July — FOMC meeting begins

29 July — US interest rate decision

30 July — US jobless claims data, US Q2 GDP data

Congress is also attempting to deliver another coronavirus relief bill as federal payments that helped to support swathes of newly unemployed people expire.

Yahoo Movies

Yahoo Movies