Tories Can Block Labour Majority With Six-Point Shift, Poll Says

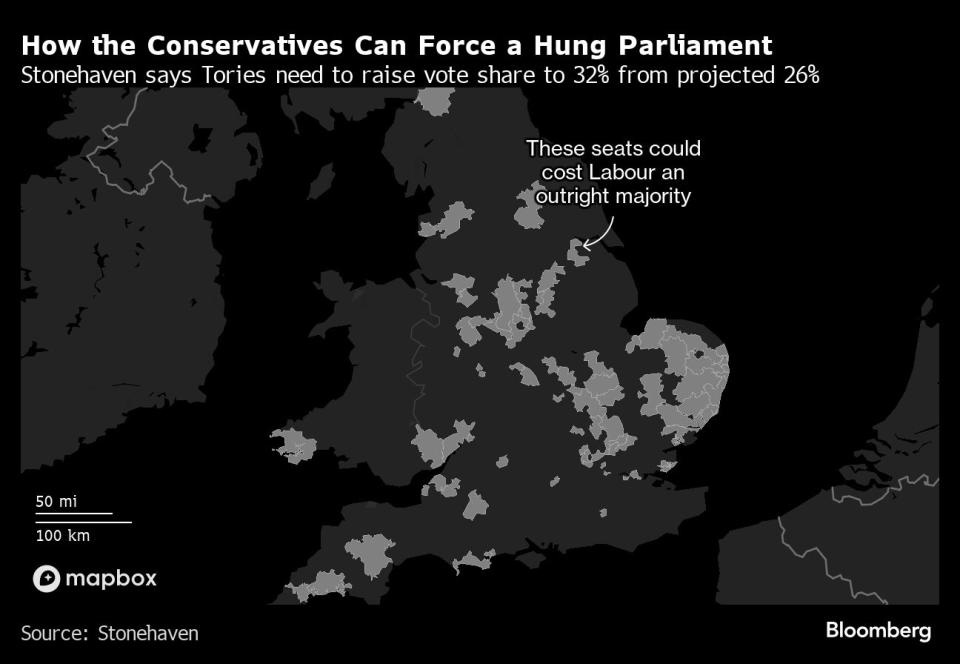

(Bloomberg) -- Prime Minister Rishi Sunak could prevent the opposition Labour Party from winning a parliamentary majority at the next election if his Conservatives can claw back just six points in the polls from voters who would have otherwise stayed at home or supported one of the UK’s minor political parties, according to data published by research consultancy Stonehaven.

Most Read from Bloomberg

McKinsey and Its Peers Are Facing the Wildest Headwinds in Years

Hulu for $1, Max for $3: Streaming Services Slash Prices This Black Friday

Sam Altman, OpenAI Board Open Talks to Negotiate His Possible Return

OpenAI Engineers Earning $800,000 a Year Turn Rare Skillset Into Leverage

The governing Tories would need to lift their vote share to 32% from 26% to deprive Keir Starmer’s party of an outright majority — if Labour’s projected vote share remains at 40%, according to Stonehaven’s modeling, which is based on a survey of about 100,000 respondents over the past 18 months.

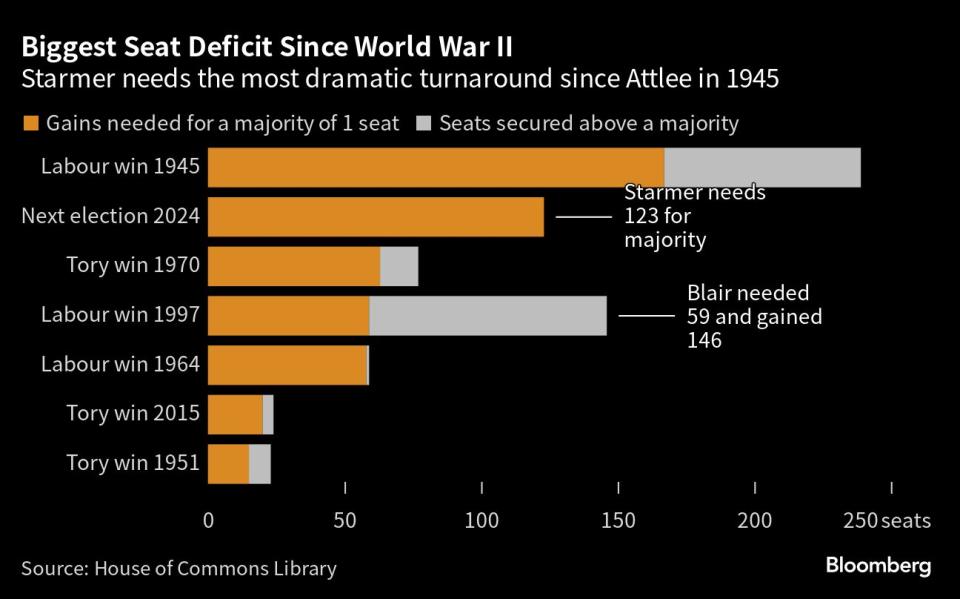

The relatively narrow margin reflects the electoral hole Labour dug for itself in 2019, when Jeremy Corbyn led the party to its worst defeat since 1935, winning just 203 of the House of Commons seats. It’s left Labour needing an additional 123 seats to win a majority, which would be its biggest turnaround since the postwar turnaround that brought Clement Attlee to power.

Measured another way, Starmer would have to increase his party’s share by over 10 percentage points compared to the last election in 2019, according to UK political think tank Labour Together. That’s not been achieved by any party since before the Labour Party was founded over a century ago.

But there are key caveats. Labour’s lead in the Stonehaven research is smaller than with other pollsters at 14, meaning that the scenario in which the Tories close the gap to 8 points is more obviously in hung Parliament territory. By contrast, YouGov’s latest survey has Labour on 44% and the Tories on 21%. For Ipsos, Labour’s lead is 21 points and for Savanta, the gap is 18 points.

Meanwhile even the Stonehaven numbers, were they not to change between now and an election expected in autumn 2024, would result in a landslide for Labour. The model shows Starmer’s party winning 402 seats for Labour and a majority of 154 over the Tories, reminiscent of Tony Blair’s historic victory in 1997.

In that scenario, the so-called Red Wall seats — Labour’s traditional heartlands which switched to Boris Johnson’s Tories in 2019 — all return to Starmer.

Still, Stonehaven’s research — and other polls like it — are why Sunak’s strategists believe they have a path to prevent a Labour majority under Britain’s first-past-the-post system, particularly if the economy improves.

“Small shifts in the national vote share can result in very significant changes in seats won,” Stonehaven’s Senior Insights Advisor Mark McInnes told Bloomberg. “The Conservatives will be focused on smaller shifts among key demographic groups rather than big leaps, if they are to deny Labour a majority.”

A hung Parliament occurs if neither of the two main parties can secure enough support. That’s why Starmer often faces questions about whether he’d be willing to do a deal with the Liberal Democrats and potentially the Greens. Based on the optics and opposition to the Tories built up over 13 years in power, the potential to forge powerful alliances looks even harder for Sunak.

Sunak’s appointment of former Prime Minister David Cameron — a symbol of a more center-right, institutionalist Toryism — to foreign secretary was widely interpreted as a change in election strategy. Analysts saw it as Sunak moving away from the disrupter tactics employed by Johnson, to a more defensive protection of the party’s seats in typically more affluent southern areas.

Conservative hopes of denying Labour a majority will hinge on traditional bell-weather Tory-Labour marginals including Norwich North, Rossendale and Darwen, and Swindon North, Stonehaven said, and seats where the Liberal Democrats are challenging like Esher and Walton, Cheadle and Eastbourne.

Also blurring the picture is the redrawn political map of Britain, as almost all parliamentary seats have had their boundaries altered to reflect changes in population. Analysis suggests the Tories may benefit slightly from the changes.

Most Read from Bloomberg Businessweek

How Elon Musk Spent Three Years Falling Down a Red-Pilled Rabbit Hole

More Americans on Ozempic Means Smaller Plates at Thanksgiving

Guatemalan Town Invests Remittance Dollars to Deter Migration

©2023 Bloomberg L.P.

Yahoo Movies

Yahoo Movies