Do Amkor Technology's (NASDAQ:AMKR) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Amkor Technology (NASDAQ:AMKR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Amkor Technology

How Quickly Is Amkor Technology Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Amkor Technology grew its EPS by 8.2% per year. That's a pretty good rate, if the company can sustain it.

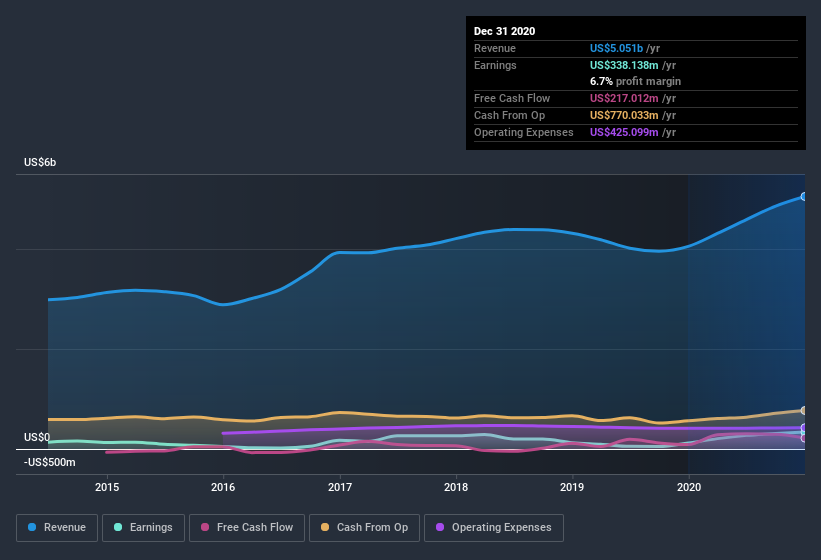

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Amkor Technology shareholders can take confidence from the fact that EBIT margins are up from 5.8% to 9.4%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Amkor Technology Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Amkor Technology insiders own a significant number of shares certainly appeals to me. In fact, they own 43% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. And their holding is extremely valuable at the current share price, totalling US$2.5b. Now that's what I call some serious skin in the game!

Should You Add Amkor Technology To Your Watchlist?

As I already mentioned, Amkor Technology is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. We should say that we've discovered 3 warning signs for Amkor Technology that you should be aware of before investing here.

Although Amkor Technology certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies