Did Alpine Income Property Trust's (NYSE:PINE) Share Price Deserve to Gain 42%?

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the Alpine Income Property Trust, Inc. (NYSE:PINE) share price is up 42% in the last year, that falls short of the market return. We'll need to follow Alpine Income Property Trust for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Alpine Income Property Trust

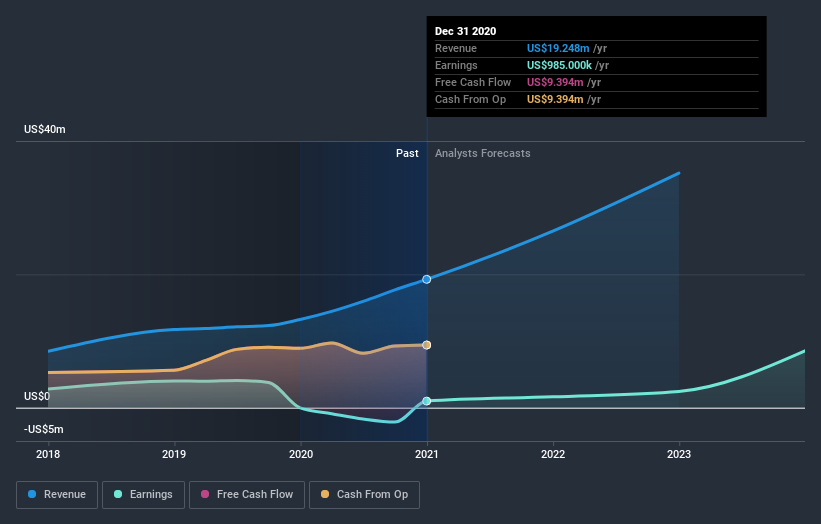

Given that Alpine Income Property Trust only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last twelve months, Alpine Income Property Trust's revenue grew by 45%. We respect that sort of growth, no doubt. The share price gain of 42% seems pretty muted, considering the growth. Its possible that shareholders had expected higher growth. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Alpine Income Property Trust has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Alpine Income Property Trust stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Alpine Income Property Trust's TSR for the last year was 50%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Alpine Income Property Trust shareholders have gained 50% for the year (even including dividends). While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 84%. It's always interesting to track share price performance over the longer term. But to understand Alpine Income Property Trust better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Alpine Income Property Trust you should be aware of, and 1 of them is a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies