Did You Miss Unitil's (NYSE:UTL) 79% Share Price Gain?

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Unitil Corporation (NYSE:UTL) share price is up 79% in the last 5 years, clearly besting than the market return of around 42% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 18% in the last year, including dividends.

See our latest analysis for Unitil

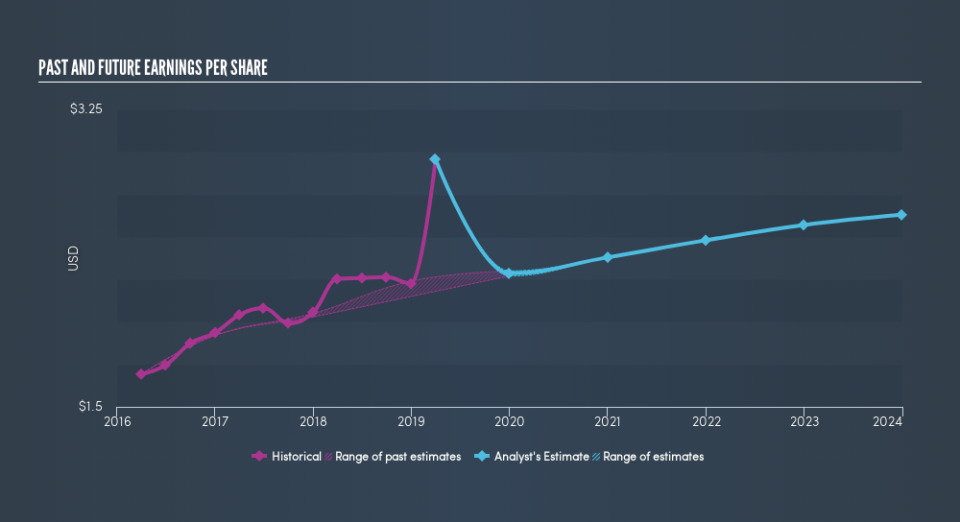

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Unitil managed to grow its earnings per share at 12% a year. That makes the EPS growth particularly close to the yearly share price growth of 12%. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Unitil has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Unitil the TSR over the last 5 years was 112%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Unitil shareholders have received a total shareholder return of 18% over one year. That's including the dividend. That's better than the annualised return of 16% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on Unitil it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies