How Does Enstar Group's (NASDAQ:ESGR) CEO Salary Compare to Peers?

Dominic Silvester became the CEO of Enstar Group Limited (NASDAQ:ESGR) in 2001, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Enstar Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Enstar Group

Comparing Enstar Group Limited's CEO Compensation With the industry

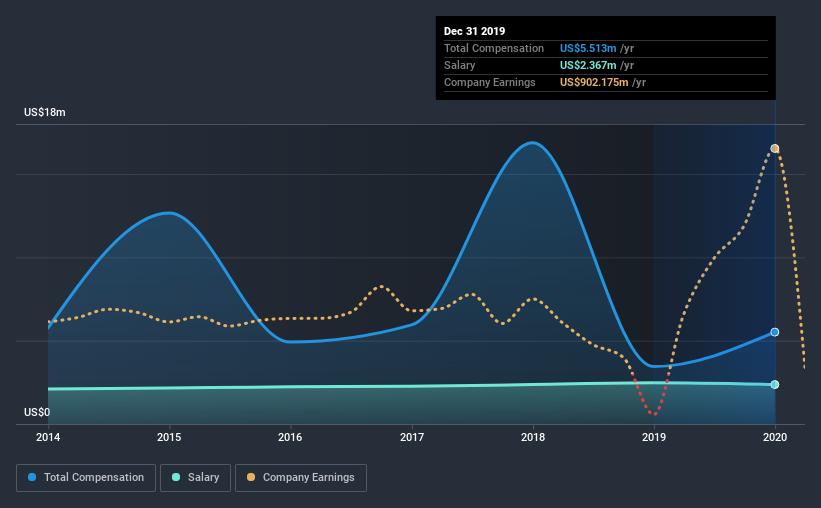

At the time of writing, our data shows that Enstar Group Limited has a market capitalization of US$3.9b, and reported total annual CEO compensation of US$5.5m for the year to December 2019. We note that's an increase of 60% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$2.4m.

For comparison, other companies in the same industry with market capitalizations ranging between US$2.0b and US$6.4b had a median total CEO compensation of US$5.6m. So it looks like Enstar Group compensates Dominic Silvester in line with the median for the industry. Furthermore, Dominic Silvester directly owns US$103m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$2.4m | US$2.5m | 43% |

Other | US$3.1m | US$974k | 57% |

Total Compensation | US$5.5m | US$3.4m | 100% |

Talking in terms of the industry, salary represented approximately 18% of total compensation out of all the companies we analyzed, while other remuneration made up 82% of the pie. Enstar Group pays out 43% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Enstar Group Limited's Growth

Over the last three years, Enstar Group Limited has shrunk its earnings per share by 55% per year. Its revenue is down 13% over the previous year.

The decline in earnings is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Enstar Group Limited Been A Good Investment?

Since shareholders would have lost about 14% over three years, some Enstar Group Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As previously discussed, Dominic is compensated close to the median for companies of its size, and which belong to the same industry. Meanwhile, earnings growth and shareholder returns have been in the red for the last three years. It's tough to call out the compensation as inappropriate, but shareholders might not favor a raise before company performance improves.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Enstar Group that you should be aware of before investing.

Switching gears from Enstar Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Movies

Yahoo Movies