If EPS Growth Is Important To You, Air Transport Services Group (NASDAQ:ATSG) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Air Transport Services Group (NASDAQ:ATSG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Air Transport Services Group with the means to add long-term value to shareholders.

See our latest analysis for Air Transport Services Group

How Fast Is Air Transport Services Group Growing Its Earnings Per Share?

Air Transport Services Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Air Transport Services Group's EPS skyrocketed from US$1.93 to US$2.85, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 48%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Air Transport Services Group shareholders is that EBIT margins have grown from 12% to 15% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

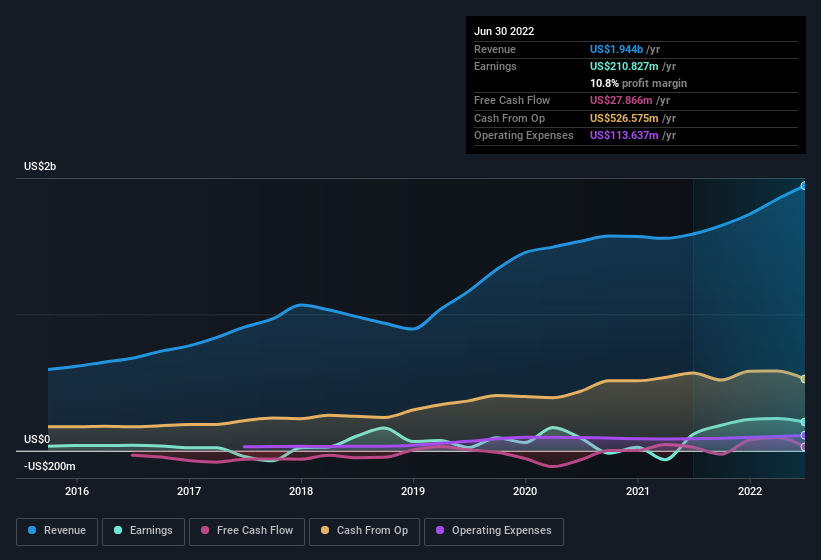

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Air Transport Services Group.

Are Air Transport Services Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Even though some insiders sold down their holdings, their actions speak louder than words with US$599k more invested than sold by people who know they company best. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by company insider David Soaper for US$998k worth of shares, at about US$24.97 per share.

Along with the insider buying, another encouraging sign for Air Transport Services Group is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$45m worth of its stock. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 2.4%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Air Transport Services Group's CEO, Rich Corrado, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Air Transport Services Group with market caps between US$1.0b and US$3.2b is about US$5.5m.

The CEO of Air Transport Services Group only received US$2.6m in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Air Transport Services Group Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Air Transport Services Group's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Air Transport Services Group , and understanding this should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Air Transport Services Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies