The Everbridge (NASDAQ:EVBG) Share Price Is Up 86% And Shareholders Are Holding On

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. To wit, the Everbridge, Inc. (NASDAQ:EVBG) share price is 86% higher than it was a year ago, much better than the market return of around 3.0% (not including dividends) in the same period. That's a solid performance by our standards! Everbridge hasn't been listed for long, so it's still not clear if it is a long term winner.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Everbridge

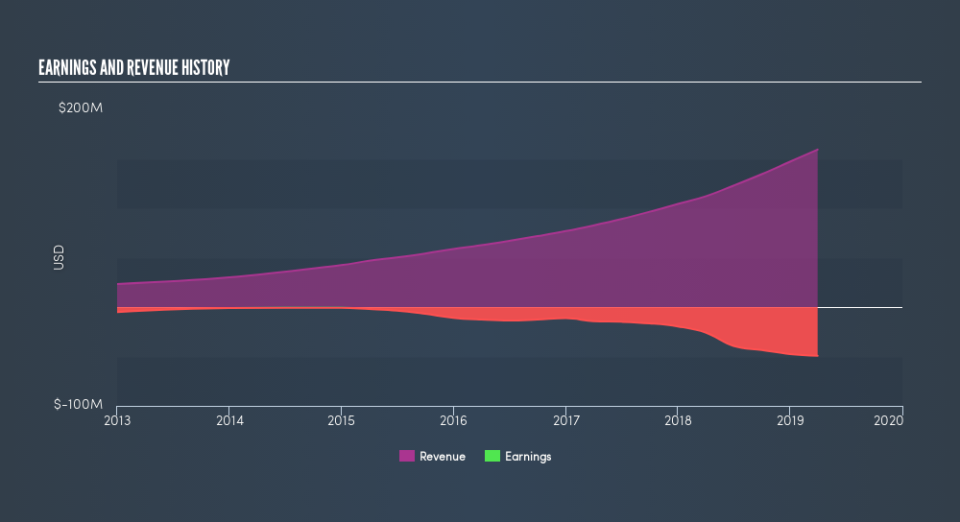

Everbridge isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Everbridge grew its revenue by 42% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 86% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But it's crucial to check profitability and cash flow before forming a view on the future.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Everbridge is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Everbridge shareholders have gained 86% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 26% in that time. This suggests the company is continuing to win over new investors. Before spending more time on Everbridge it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies