If You Had Bought i3 Verticals (NASDAQ:IIIV) Shares A Year Ago You'd Have Earned 41% Returns

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the i3 Verticals, Inc. (NASDAQ:IIIV) share price is up 41% in the last year, that falls short of the market return. i3 Verticals hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for i3 Verticals

i3 Verticals wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

i3 Verticals actually shrunk its revenue over the last year, with a reduction of 54%. Given the revenue reduction the modest 41% share price rise over the year seems pretty decent. Generally we're pretty unenthusiastic about loss making stocks that are not growing revenue.

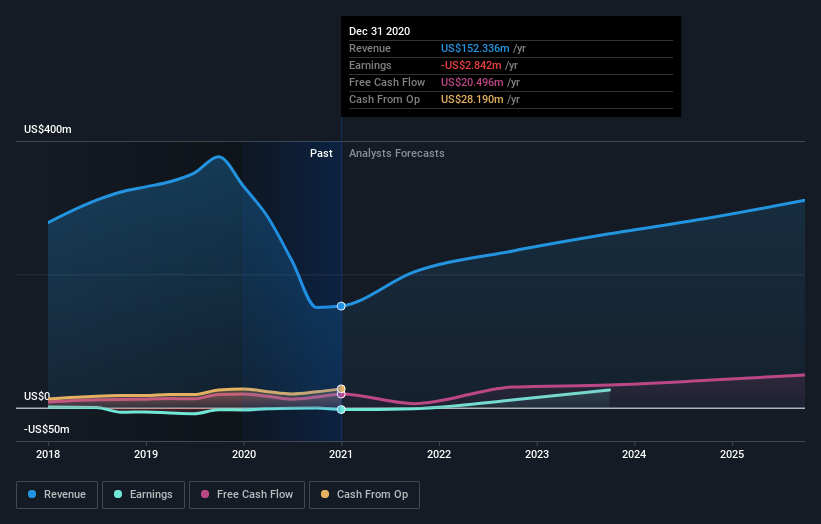

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on i3 Verticals

A Different Perspective

We're happy to report that i3 Verticals are up 41% over the year. Unfortunately this falls short of the market return of around 55%. The last three months haven't been so kind to i3 Verticals, with the share price gaining just 7.6%. It's not uncommon to see a company's share price between updates to shareholders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with i3 Verticals .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies