Here's Why Shareholders May Want To Be Cautious With Increasing Astrotech Corporation's (NASDAQ:ASTC) CEO Pay Packet

The underwhelming share price performance of Astrotech Corporation (NASDAQ:ASTC) in the past three years would have disappointed many shareholders. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 26 May 2021. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Astrotech

Comparing Astrotech Corporation's CEO Compensation With the industry

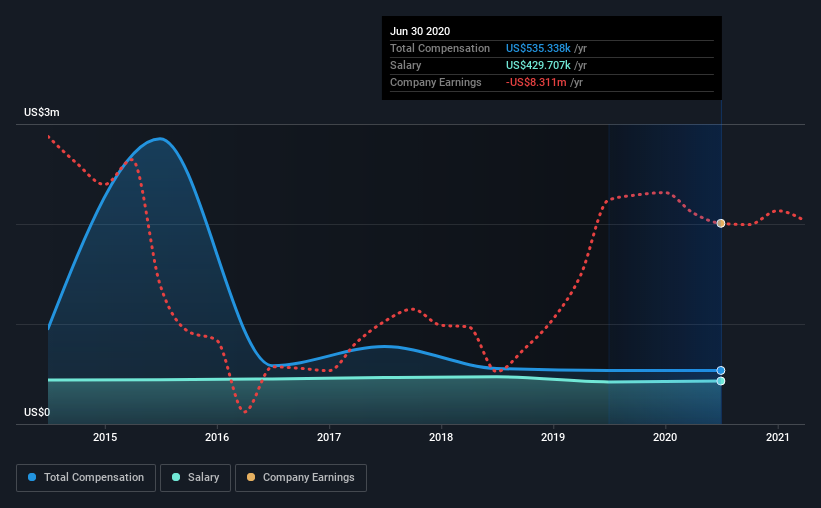

Our data indicates that Astrotech Corporation has a market capitalization of US$55m, and total annual CEO compensation was reported as US$535k for the year to June 2020. That is, the compensation was roughly the same as last year. Notably, the salary which is US$429.7k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$532k. This suggests that Astrotech remunerates its CEO largely in line with the industry average. Furthermore, Tom Pickens directly owns US$3.2m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$430k | US$421k | 80% |

Other | US$106k | US$114k | 20% |

Total Compensation | US$535k | US$535k | 100% |

On an industry level, around 17% of total compensation represents salary and 83% is other remuneration. Astrotech is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Astrotech Corporation's Growth

Astrotech Corporation's earnings per share (EPS) grew 47% per year over the last three years. Its revenue is up 19% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Astrotech Corporation Been A Good Investment?

The return of -42% over three years would not have pleased Astrotech Corporation shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 4 warning signs for Astrotech (2 are potentially serious!) that you should be aware of before investing here.

Important note: Astrotech is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies