Here's Why We're Not Too Worried About KVH Industries's (NASDAQ:KVHI) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether KVH Industries (NASDAQ:KVHI) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for KVH Industries

When Might KVH Industries Run Out Of Money?

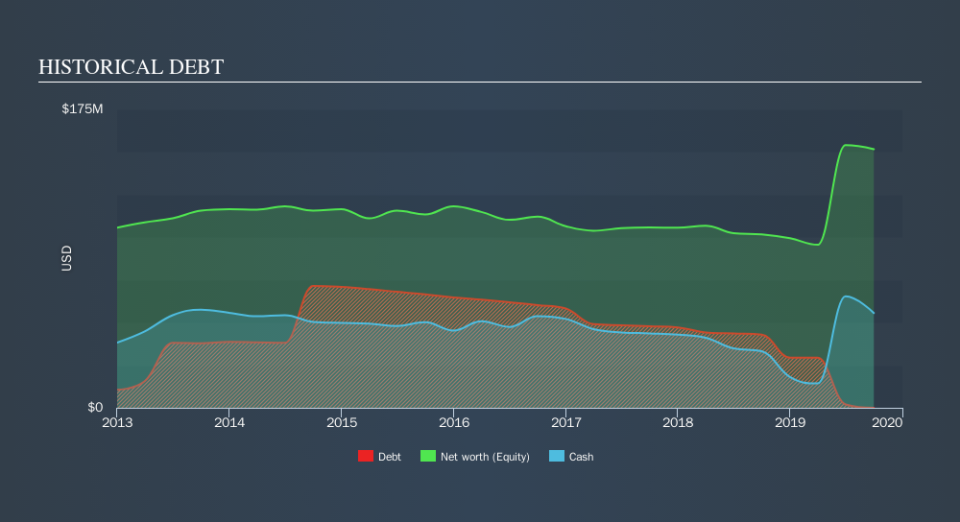

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In September 2019, KVH Industries had US$56m in cash, and was debt-free. In the last year, its cash burn was US$22m. So it had a cash runway of about 2.5 years from September 2019. Importantly, though, analysts think that KVH Industries will reach cashflow breakeven before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

How Well Is KVH Industries Growing?

Notably, KVH Industries actually ramped up its cash burn very hard and fast in the last year, by 115%, signifying heavy investment in the business. That does give us pause, and we can't take much solace in the operating revenue growth of 13% in the same time frame. Taken together, we think these growth metrics are a little worrying. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can KVH Industries Raise Cash?

While KVH Industries seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash to fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

KVH Industries's cash burn of US$22m is about 12% of its US$181m market capitalisation. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is KVH Industries's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about KVH Industries's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although we do find its increasing cash burn to be a bit of a negative, once we consider the other metrics mentioned in this article together, the overall picture is one we are comfortable with. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: KVH Industries insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies