Introducing American Superconductor (NASDAQ:AMSC), The Stock That Zoomed 143% In The Last Year

American Superconductor Corporation (NASDAQ:AMSC) shareholders might understandably be very concerned that the share price has dropped 45% in the last quarter. Despite this, the stock is a strong performer over the last year, no doubt about that. Like an eagle, the share price soared 143% in that time. So we think most shareholders won't be too upset about the recent fall. The real question is whether the business is trending in the right direction.

View our latest analysis for American Superconductor

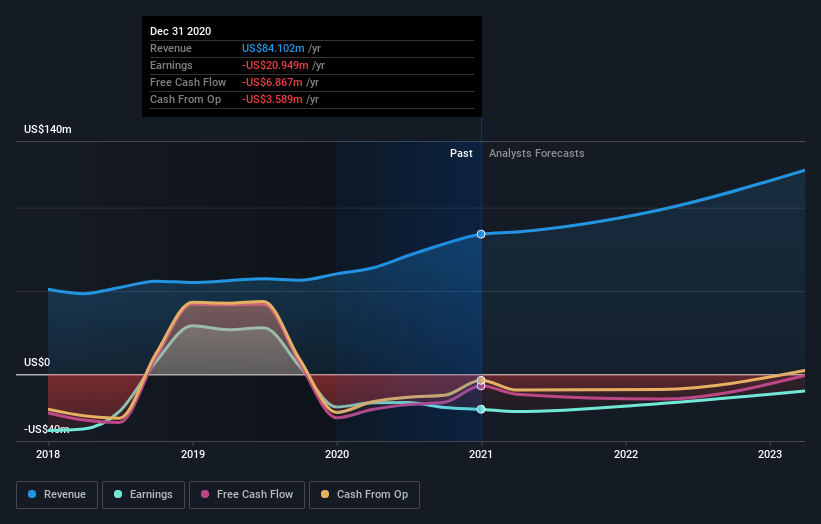

American Superconductor isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year American Superconductor saw its revenue grow by 39%. That's a fairly respectable growth rate. While that revenue growth is pretty good the share price performance outshone it, with a lift of 143% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on American Superconductor's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that American Superconductor shareholders have received a total shareholder return of 143% over one year. That gain is better than the annual TSR over five years, which is 6%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for American Superconductor that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies