Introducing Pacira BioSciences (NASDAQ:PCRX), The Stock That Slid 64% In The Last Five Years

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. For example the Pacira BioSciences, Inc. (NASDAQ:PCRX) share price dropped 64% over five years. That is extremely sub-optimal, to say the least. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

View our latest analysis for Pacira BioSciences

While Pacira BioSciences made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last half decade, Pacira BioSciences saw its revenue increase by 13% per year. That's a pretty good rate for a long time period. The share price, meanwhile, has fallen 18% compounded, over five years. It seems probably that the business has failed to live up to initial expectations. A pessimistic market can create opportunities.

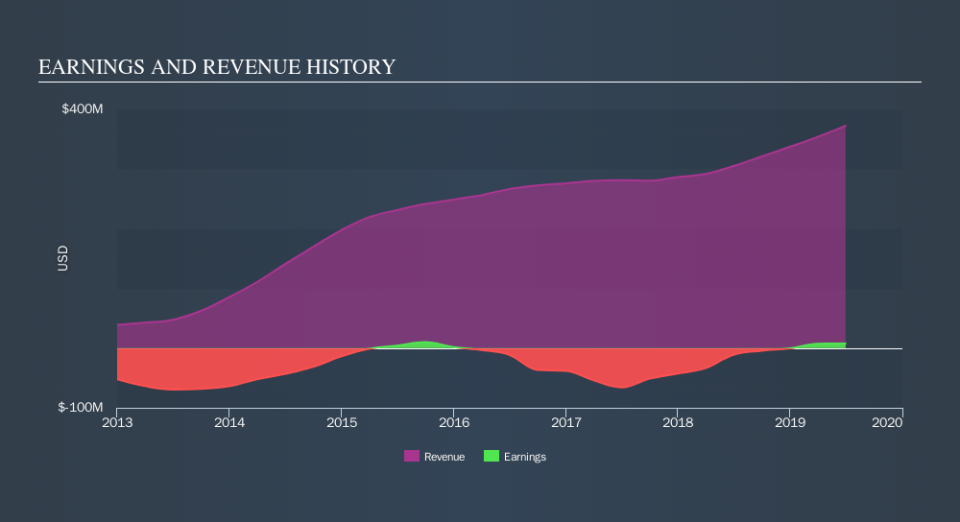

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Pacira BioSciences will earn in the future (free profit forecasts).

A Different Perspective

Investors in Pacira BioSciences had a tough year, with a total loss of 17%, against a market gain of about 8.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 18% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies