Introducing Penumbra (NYSE:PEN), The Stock That Zoomed 151% In The Last Three Years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. To wit, the Penumbra, Inc. (NYSE:PEN) share price has flown 151% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 15% gain in the last three months. But this could be related to the strong market, which is up 6.6% in the last three months.

View our latest analysis for Penumbra

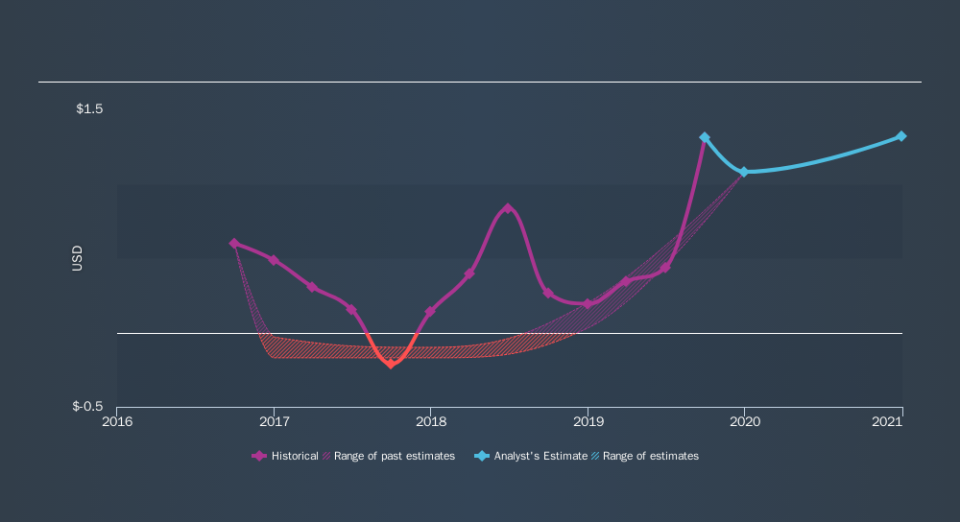

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Penumbra achieved compound earnings per share growth of 30% per year. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 36% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Quite to the contrary, the share price has arguably reflected the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Penumbra's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, Penumbra's total shareholder return last year was 36%. So this year's TSR was actually better than the three-year TSR (annualized) of 36%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Penumbra may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies