Investors Who Bought Baidu (NASDAQ:BIDU) Shares Five Years Ago Are Now Down 52%

Baidu, Inc. (NASDAQ:BIDU) shareholders should be happy to see the share price up 18% in the last month. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 52% after a long stretch. So we're hesitant to put much weight behind the short term increase. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

View our latest analysis for Baidu

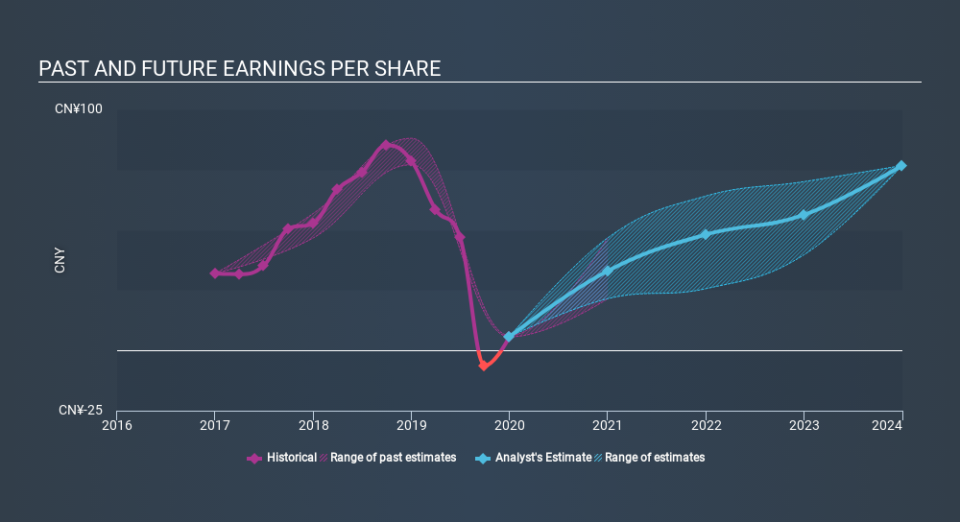

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Baidu's earnings per share (EPS) dropped by 31% each year. The share price decline of 14% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve. The high P/E ratio of 130.67 suggests that shareholders believe earnings will grow in the years ahead.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Baidu's key metrics by checking this interactive graph of Baidu's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Baidu shareholders are down 39% for the year. Unfortunately, that's worse than the broader market decline of 0.8%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 14% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Baidu that you should be aware of.

But note: Baidu may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Movies

Yahoo Movies