Investors Could Be Concerned With Oil-Dri Corporation of America's (NYSE:ODC) Returns On Capital

When researching a stock for investment, what can tell us that the company is in decline? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. So after we looked into Oil-Dri Corporation of America (NYSE:ODC), the trends above didn't look too great.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Oil-Dri Corporation of America:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.069 = US$13m ÷ (US$228m - US$39m) (Based on the trailing twelve months to July 2021).

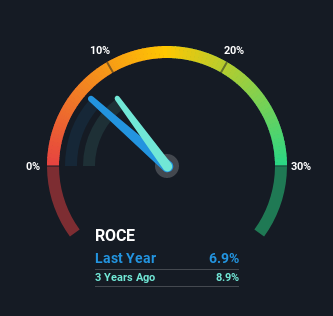

So, Oil-Dri Corporation of America has an ROCE of 6.9%. Ultimately, that's a low return and it under-performs the Household Products industry average of 19%.

View our latest analysis for Oil-Dri Corporation of America

Historical performance is a great place to start when researching a stock so above you can see the gauge for Oil-Dri Corporation of America's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Oil-Dri Corporation of America, check out these free graphs here.

How Are Returns Trending?

In terms of Oil-Dri Corporation of America's historical ROCE movements, the trend doesn't inspire confidence. Unfortunately the returns on capital have diminished from the 8.8% that they were earning five years ago. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Oil-Dri Corporation of America becoming one if things continue as they have.

Our Take On Oil-Dri Corporation of America's ROCE

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Despite the concerning underlying trends, the stock has actually gained 22% over the last five years, so it might be that the investors are expecting the trends to reverse. Regardless, we don't like the trends as they are and if they persist, we think you might find better investments elsewhere.

If you'd like to know about the risks facing Oil-Dri Corporation of America, we've discovered 1 warning sign that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies