Investors in Oportun Financial (NASDAQ:OPRT) have unfortunately lost 47% over the last year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Oportun Financial Corporation (NASDAQ:OPRT) have tasted that bitter downside in the last year, as the share price dropped 47%. That contrasts poorly with the market decline of 8.5%. Because Oportun Financial hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 31% in the last 90 days.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for Oportun Financial

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

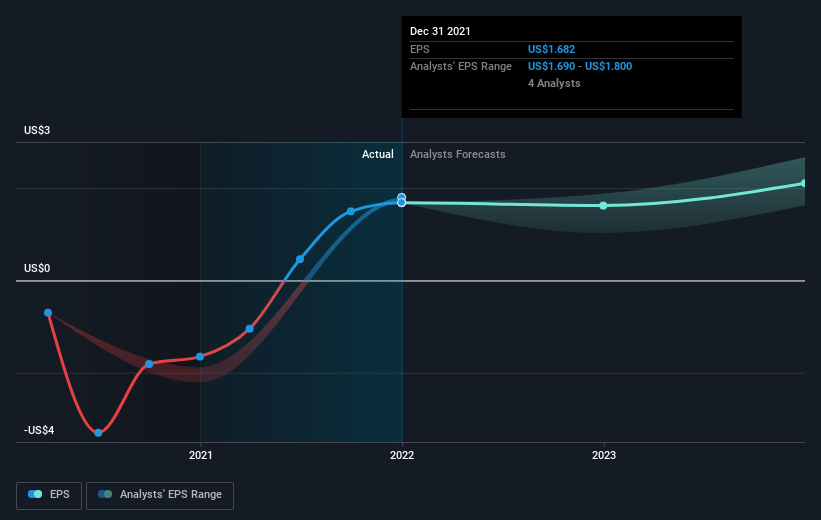

Oportun Financial managed to increase earnings per share from a loss to a profit, over the last 12 months.

We're surprised that the share price is lower given that improvement. If the company can sustain the earnings growth, this might be an inflection point for the business, which would make right now a really interesting time to study it more closely.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Oportun Financial has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

Oportun Financial shareholders are down 47% for the year, even worse than the market loss of 8.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 31%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Oportun Financial better, we need to consider many other factors. For example, we've discovered 5 warning signs for Oportun Financial (1 can't be ignored!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies