Shareholders in American Outdoor Brands (NASDAQ:AOUT) are in the red if they invested a year ago

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held American Outdoor Brands, Inc. (NASDAQ:AOUT) over the last year knows what a loser feels like. The share price has slid 63% in that time. We wouldn't rush to judgement on American Outdoor Brands because we don't have a long term history to look at.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for American Outdoor Brands

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

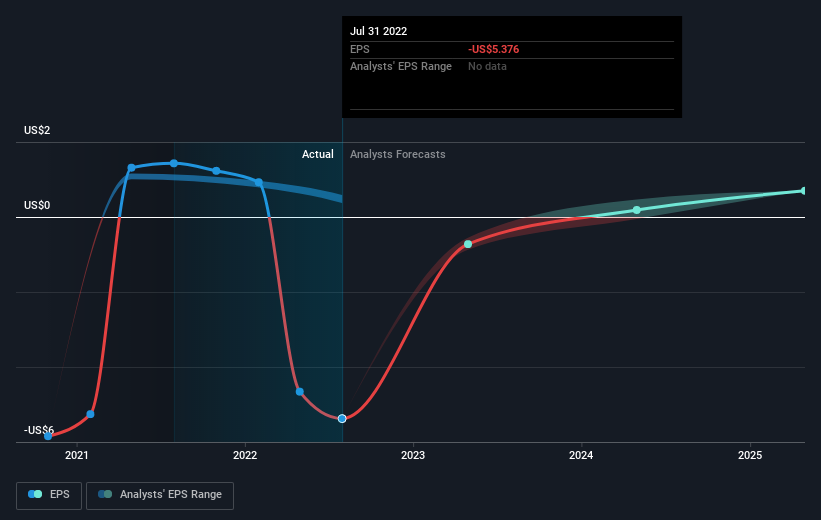

American Outdoor Brands fell to a loss making position during the year. Some investors no doubt dumped the stock as a result. Of course, if the company can turn the situation around, investors will likely profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

American Outdoor Brands shareholders are down 63% for the year, even worse than the market loss of 19%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 6.7% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand American Outdoor Brands better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for American Outdoor Brands you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies