Skillz (SKLZ) to Report Q1 Earnings: What's in The Offing?

Skillz Inc. SKLZ is scheduled to report first-quarter 2022 results on May 4, after market close. In the last reported quarter, the company reported a negative earnings surprise of 78.6%.

How Are Estimates Placed?

The Zacks Consensus Estimate for the first-quarter bottom line is pegged at a loss of 18 cents per share, indicating a deterioration of 38.5% from a loss of 13 cents reported in the year-ago quarter.

For revenues, the consensus mark is pegged at $94.6 million. The projection suggests an increase of 13.1% from the year-ago quarter’s reported figure.

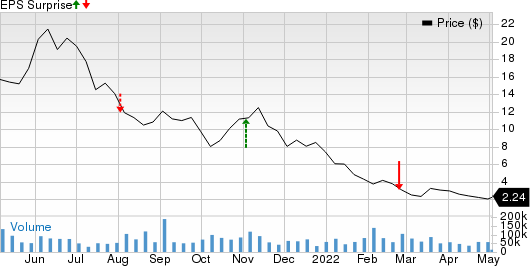

Skillz Inc. Price and EPS Surprise

Skillz Inc. price-eps-surprise | Skillz Inc. Quote

Let's take a look at how things have shaped up in the quarter.

Factors at Play

Skillz’s first-quarter performance is likely to have benefited from greater adoption of mobile gaming, the Aarki acquisition, user-acquisition efforts and strategic partnerships. This along with a focus on better content and products (for its developer customers) coupled with conversion of gamers and developers (from ads and in-game purchases) is likely to have driven the company’s top line in the first quarter.

Emphasis on eliminating low-return engagement marketing programs (that are cannibalizing profit generation) and a decline in user acquisition costs are likely to have aided margins in the to-be-reported quarter.

Competition from other forms of entertainment and exposure to consumer spending are likely to have influenced the company’s first-quarter performance.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Skillz this time around. A stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) to beat earnings. But that's not the case here.

Earnings ESP: Skillz has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks Poised to Beat Earnings Estimates

Here are some stocks from the Zacks Consumer Discretionary space that investors may consider as our model shows that these have the right combination of elements to post an earnings beat.

Golden Entertainment, Inc. GDEN has an Earnings ESP of +7.72% and a Zacks Rank #2.

Shares of Golden Entertainment have gained 43.2% in the past year. GDEN’s earnings surpassed the consensus mark thrice in the trailing four quarters and missed once, the average surprise being 204.7%.

Callaway Golf Company ELY has an Earnings ESP of +7.22% and a Zacks Rank #3.

Shares of Callaway have declined 23.4% in the past year. ELY’s earnings surpassed the consensus mark in all of the trailing four quarters, the average surprise being 1,047.2%.

Penn National Gaming, Inc. PENN has an Earnings ESP of +9.50% and a Zacks Rank #3.

Shares of Penn National have declined 16.2% in the past three months. PENN’s earnings surpassed the consensus mark twice in the trailing four quarters and missed twice, the average surprise being 6.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Penn National Gaming, Inc. (PENN) : Free Stock Analysis Report

Callaway Golf Company (ELY) : Free Stock Analysis Report

Golden Entertainment, Inc. (GDEN) : Free Stock Analysis Report

Skillz Inc. (SKLZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Movies

Yahoo Movies