Air Transport Services Group (NASDAQ:ATSG) Seems To Be Using An Awful Lot Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Air Transport Services Group, Inc. (NASDAQ:ATSG) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Air Transport Services Group

What Is Air Transport Services Group's Debt?

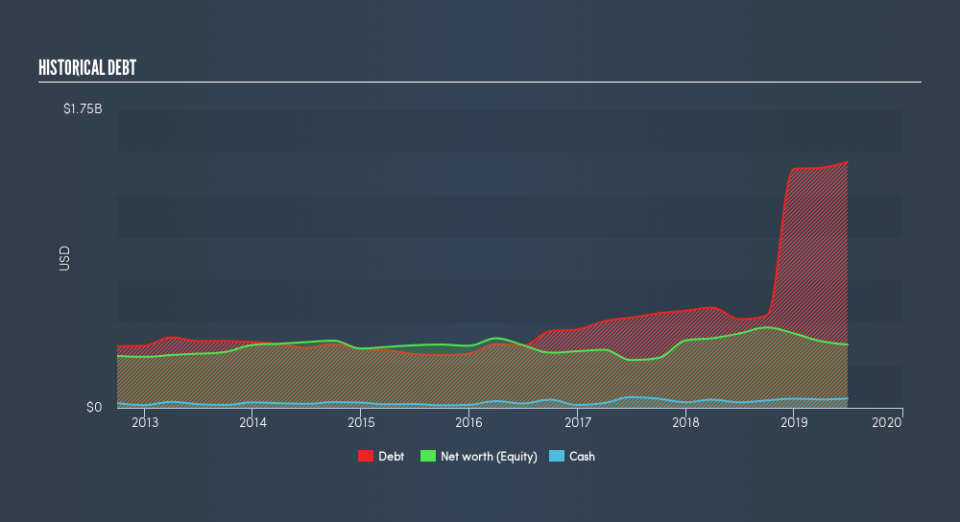

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Air Transport Services Group had US$1.44b of debt, an increase on US$520.7m, over one year. However, because it has a cash reserve of US$54.8m, its net debt is less, at about US$1.39b.

How Healthy Is Air Transport Services Group's Balance Sheet?

We can see from the most recent balance sheet that Air Transport Services Group had liabilities of US$259.0m falling due within a year, and liabilities of US$2.07b due beyond that. On the other hand, it had cash of US$54.8m and US$128.5m worth of receivables due within a year. So its liabilities total US$2.15b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$1.17b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt After all, Air Transport Services Group would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Air Transport Services Group's debt to EBITDA ratio (3.6) suggests that it uses some debt, its interest cover is very weak, at 2.3, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. The good news is that Air Transport Services Group grew its EBIT a smooth 37% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Air Transport Services Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Air Transport Services Group saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Air Transport Services Group's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, it seems to us that Air Transport Services Group's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Given the risks around Air Transport Services Group's use of debt, the sensible thing to do is to check if insiders have been unloading the stock.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies