iHuman Inc.'s (NYSE:IH) Shares Lagging The Market But So Is The Business

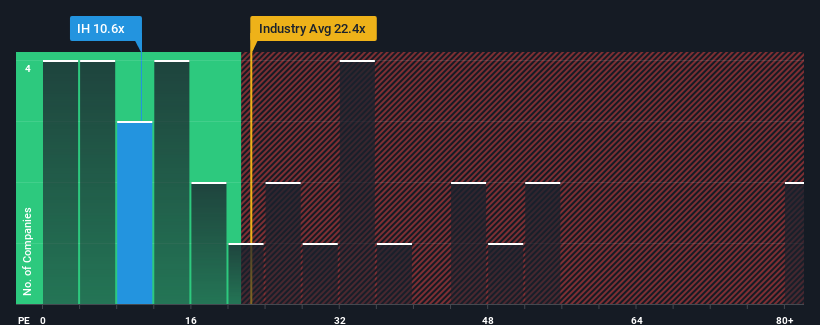

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 16x, you may consider iHuman Inc. (NYSE:IH) as an attractive investment with its 10.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We'd have to say that with no tangible growth over the last year, iHuman's earnings have been unimpressive. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for iHuman

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on iHuman will help you shine a light on its historical performance.

Is There Any Growth For iHuman?

iHuman's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Comparing that to the market, which is predicted to deliver 4.5% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that iHuman's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that iHuman maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for iHuman that you should be aware of.

If these risks are making you reconsider your opinion on iHuman, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies